Navigating the Bay Area Housing Market: A Look Ahead to 2025

Navigating the Bay Area Housing Market: A Look Ahead to 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Bay Area Housing Market: A Look Ahead to 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Bay Area Housing Market: A Look Ahead to 2025

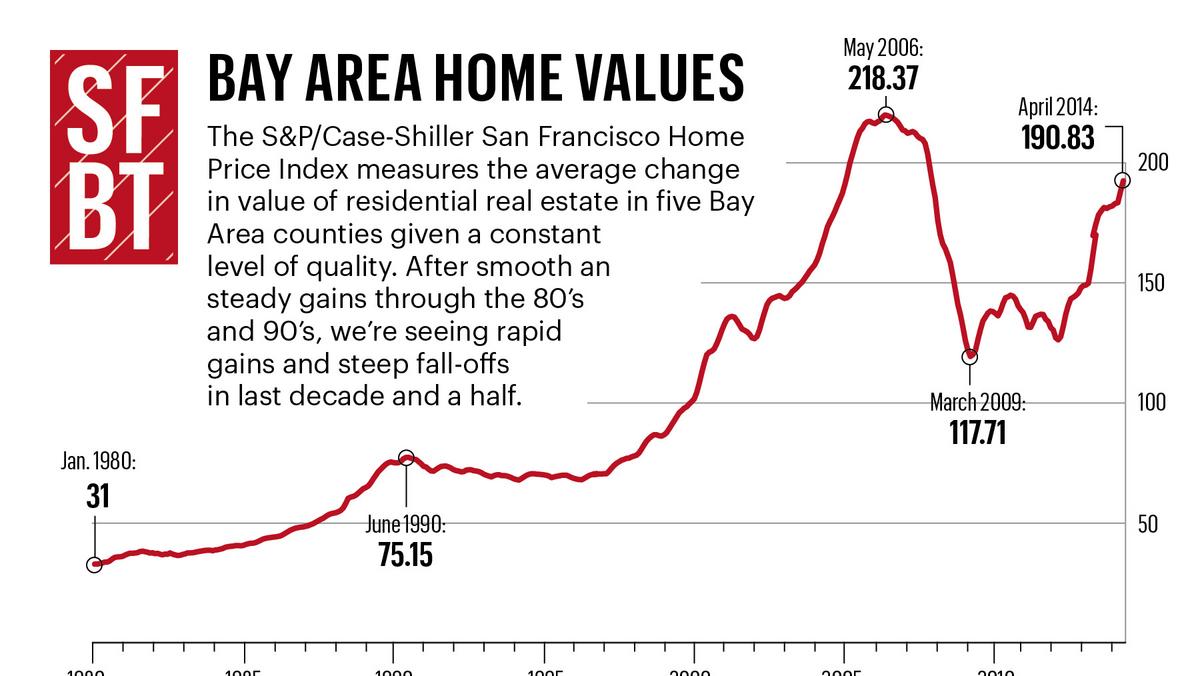

The Bay Area housing market is notorious for its volatility and high prices. While the region boasts a thriving economy and exceptional quality of life, the cost of living, particularly housing, remains a significant challenge for many. Understanding the housing price trends in the Bay Area is crucial for both current residents and those considering moving to the area. This article delves into the factors influencing housing prices in the Bay Area and offers insights into what the market might look like in 2025.

Key Drivers of Bay Area Housing Prices

Several factors contribute to the high and fluctuating housing prices in the Bay Area:

- Strong Economy: The region’s robust economy, driven by technology companies, research institutions, and a thriving entrepreneurial ecosystem, attracts skilled workers and investors, increasing demand for housing.

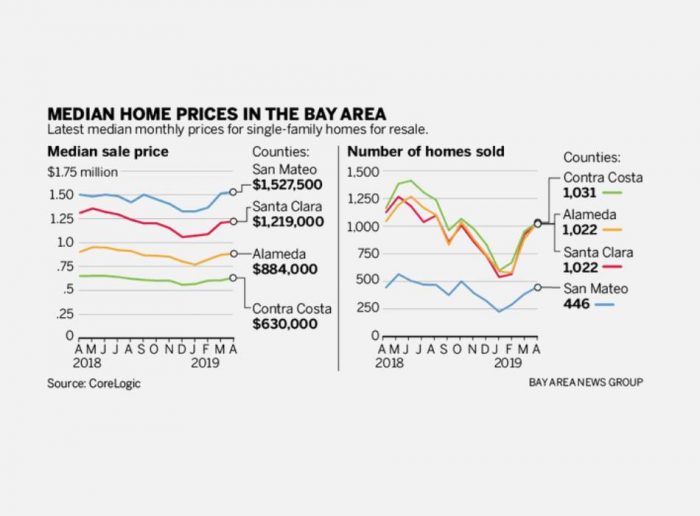

- Limited Housing Supply: The Bay Area faces a chronic shortage of housing units, particularly affordable options. This limited supply, coupled with high demand, fuels price increases.

- High Demand: The Bay Area is a highly desirable location for its lifestyle, amenities, and access to job opportunities. This strong demand further contributes to rising prices.

- Low Interest Rates: Historically low interest rates in recent years have made homeownership more affordable, leading to increased demand and price escalation.

- Investor Activity: Institutional investors and individual investors have increasingly participated in the Bay Area real estate market, further driving up prices.

- Land Use Restrictions: Zoning regulations and environmental concerns limit the development of new housing units, contributing to the supply shortage.

- Rising Construction Costs: The cost of materials, labor, and permits has risen in recent years, making new construction more expensive and impacting housing prices.

Forecasting Housing Price Trends in the Bay Area in 2025

Predicting future housing prices is challenging due to the complex interplay of economic, demographic, and policy factors. However, several factors suggest potential trends for housing price trends in the Bay Area by 2025:

- Economic Growth: The Bay Area’s strong economy is expected to continue, potentially driving further demand for housing. However, economic uncertainties, including inflation and potential recessions, could impact growth and influence housing prices.

- Interest Rate Increases: The Federal Reserve has been raising interest rates to combat inflation, which could make borrowing more expensive and potentially cool the housing market.

- Housing Supply: The Bay Area faces a significant housing supply challenge. While some new developments are underway, it remains unclear whether the pace of construction will be sufficient to meet future demand.

- Policy Changes: Local and state governments are implementing policies to address the affordability crisis, such as increasing housing density, streamlining permitting processes, and providing incentives for affordable housing development. These initiatives could impact future price trends.

- Remote Work Trends: The rise of remote work has allowed some workers to relocate outside of the Bay Area, potentially reducing demand and moderating price growth. However, the long-term impact of remote work on the Bay Area housing market remains uncertain.

Potential Scenarios for Housing Prices in 2025

Based on the factors mentioned above, several potential scenarios for housing price trends in the Bay Area by 2025 can be considered:

- Scenario 1: Continued Price Growth: If the Bay Area’s economy remains strong, interest rates remain relatively low, and housing supply remains constrained, prices could continue to rise, albeit at a slower pace than in recent years.

- Scenario 2: Price Stabilization: If interest rate increases moderate demand, and new housing units are developed at a faster pace, prices could stabilize or even experience slight declines.

- Scenario 3: Price Correction: In a more pessimistic scenario, a significant economic downturn or a sharp increase in interest rates could lead to a correction in the housing market, resulting in price drops.

Related Searches:

- Bay Area Housing Market Forecast 2025: This search focuses on specific predictions for the Bay Area housing market in 2025, including price trends, inventory levels, and potential market shifts.

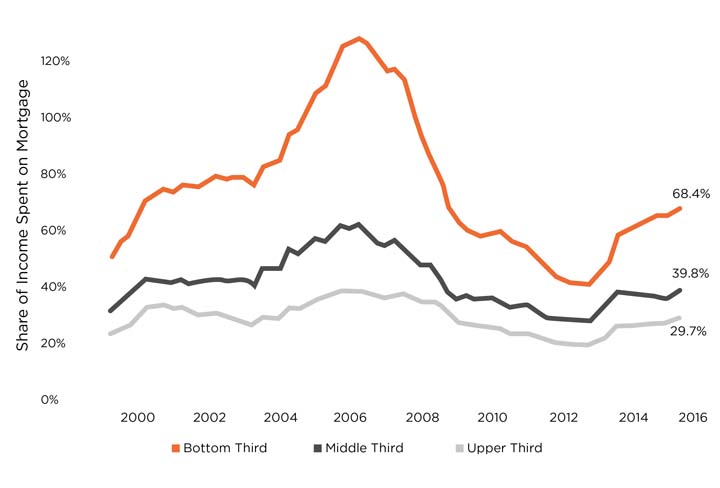

- Bay Area Housing Affordability 2025: This search explores the affordability challenges in the Bay Area and how they might evolve by 2025, focusing on factors like income levels, housing costs, and access to affordable housing options.

- Bay Area Housing Market Trends 2025: This search delves into the broader trends influencing the Bay Area housing market, including demographic changes, economic growth, and government policies.

- Bay Area Real Estate Investment 2025: This search focuses on the investment potential in the Bay Area real estate market, considering factors like rental yields, property values, and market risks.

- Bay Area Housing Inventory 2025: This search examines the expected availability of housing units in the Bay Area by 2025, considering new construction, existing inventory, and potential changes in demand.

- Bay Area Housing Market Bubble 2025: This search investigates the potential for a housing bubble in the Bay Area, analyzing factors like price-to-income ratios, affordability levels, and historical market cycles.

- Bay Area Housing Market Outlook 2025: This search provides a comprehensive overview of the Bay Area housing market, including predictions for price trends, inventory levels, and overall market health.

- Bay Area Housing Market Predictions 2025: This search focuses on specific predictions from experts and analysts regarding the future of the Bay Area housing market.

FAQs

Q: Will housing prices in the Bay Area continue to rise in 2025?

A: The future of housing price trends in the Bay Area is uncertain. While the region’s strong economy and limited housing supply could continue to drive prices upwards, factors like rising interest rates and potential economic downturns could moderate or even reverse this trend.

Q: How will interest rate increases impact Bay Area housing prices?

A: Rising interest rates make borrowing more expensive, potentially reducing demand for housing and slowing down price growth. However, the extent of this impact depends on the magnitude of the interest rate increases and the overall economic climate.

Q: Is there a housing bubble in the Bay Area?

A: The possibility of a housing bubble in the Bay Area is a topic of debate. Some indicators, such as high price-to-income ratios and limited affordability, suggest potential risks. However, the Bay Area’s strong economy and limited housing supply could also support continued price growth.

Q: What are the best neighborhoods to buy in the Bay Area in 2025?

A: Choosing the best neighborhoods to buy in the Bay Area depends on individual preferences, budget, and lifestyle needs. Factors to consider include proximity to employment centers, access to amenities, school districts, and future development plans.

Q: How can I prepare for the Bay Area housing market in 2025?

A: To prepare for the Bay Area housing market in 2025, it is essential to:

- Monitor market trends: Stay informed about housing price trends, inventory levels, and interest rate changes.

- Improve your financial situation: Build a strong credit score, save for a down payment, and consider pre-approval for a mortgage.

- Explore different housing options: Consider alternative housing options, such as condos, townhomes, or multi-family properties.

- Be patient and flexible: The Bay Area housing market is competitive. Be prepared to make compromises and be patient in your search.

Tips

- Consult with a real estate agent: A knowledgeable real estate agent can provide valuable insights into the local market, help you navigate the buying process, and negotiate the best price.

- Consider the long-term outlook: When making a housing decision, consider the long-term outlook for the Bay Area economy and housing market.

- Stay informed about policy changes: Keep abreast of local and state government policies that could impact housing prices and availability.

- Explore affordable housing options: Consider affordable housing programs and initiatives to find more affordable housing options.

Conclusion

The Bay Area housing market is complex and dynamic, with several factors influencing housing price trends in the Bay Area. While the region’s strong economy and limited housing supply could continue to drive prices upwards, factors like interest rate increases, potential economic downturns, and policy changes could moderate or even reverse this trend. Understanding the factors driving the market and preparing for potential scenarios is crucial for anyone considering buying or selling a home in the Bay Area. By staying informed, planning ahead, and seeking professional guidance, individuals can navigate the Bay Area housing market effectively and make informed decisions about their housing goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Bay Area Housing Market: A Look Ahead to 2025. We hope you find this article informative and beneficial. See you in our next article!