Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025

Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025

- 2 Introduction

- 3 Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025

- 3.1 Understanding the Dynamics

- 3.2 The Significance of the real estate market trends graph 2025****

- 3.3 Exploring Related Searches

- 3.4 FAQs about the real estate market trends graph 2025****

- 3.5 Tips for Utilizing the real estate market trends graph 2025****

- 3.6 Conclusion

- 4 Closure

Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025

The real estate market is a dynamic entity, constantly fluctuating in response to economic forces, demographic shifts, and technological advancements. Understanding these trends is crucial for investors, buyers, and sellers alike, as it provides valuable insights into potential opportunities and risks. This article delves into the real estate market trends graph 2025, exploring key factors influencing its trajectory and offering a comprehensive overview of what the future holds.

Understanding the Dynamics

The real estate market trends graph 2025 is not a single, static prediction. It is a dynamic representation of multiple interwoven trends, each with its own set of drivers and potential impacts. To truly grasp the significance of this graph, it’s essential to dissect its components:

1. Economic Factors:

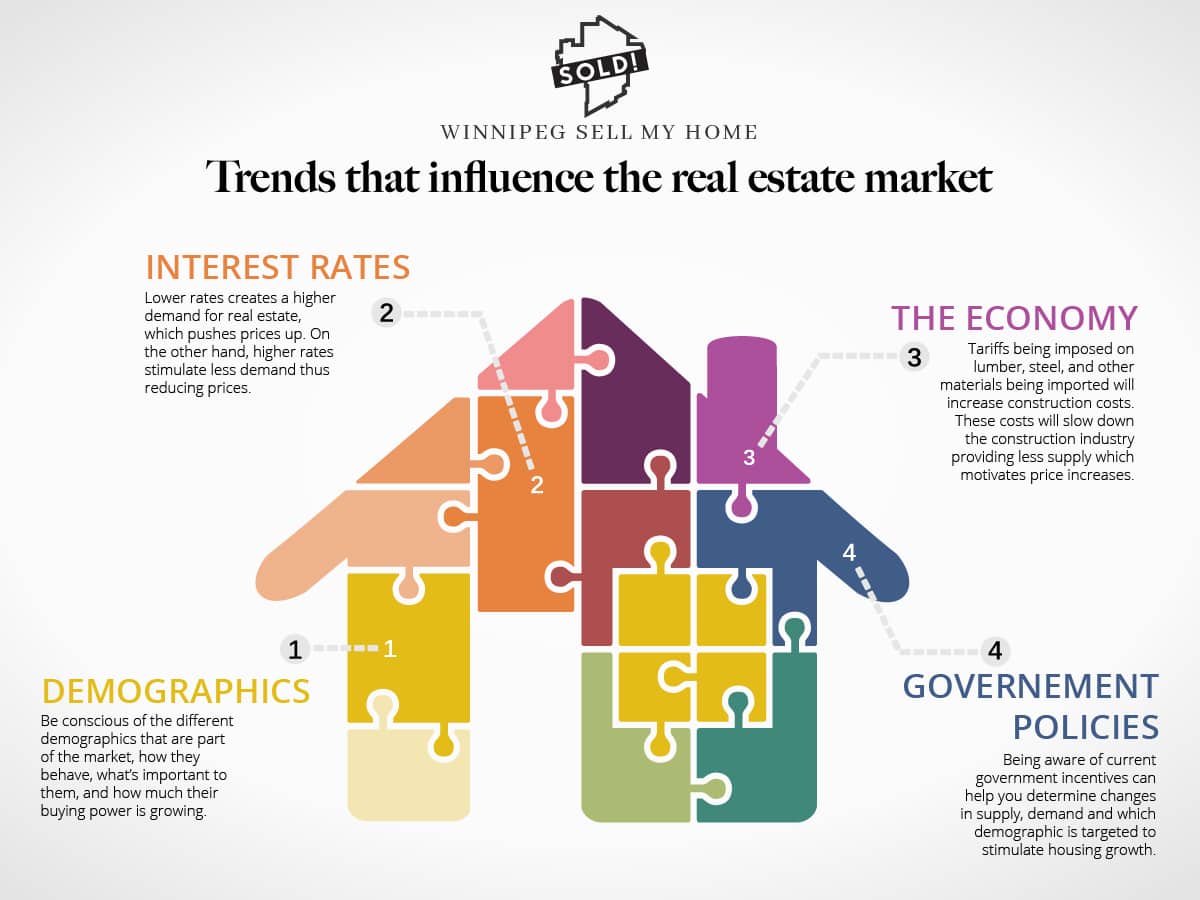

- Interest Rates: Rising interest rates can significantly impact affordability, potentially slowing down home purchases. Conversely, lower rates can stimulate demand and drive prices up.

- Inflation: High inflation erodes purchasing power and can lead to increased building costs, impacting both supply and demand.

- Economic Growth: A robust economy typically translates to higher employment and disposable income, boosting demand for housing. Conversely, economic downturns can lead to market stagnation.

- Government Policies: Tax incentives, zoning regulations, and infrastructure projects can influence housing supply and affordability, impacting the overall market trajectory.

2. Demographic Shifts:

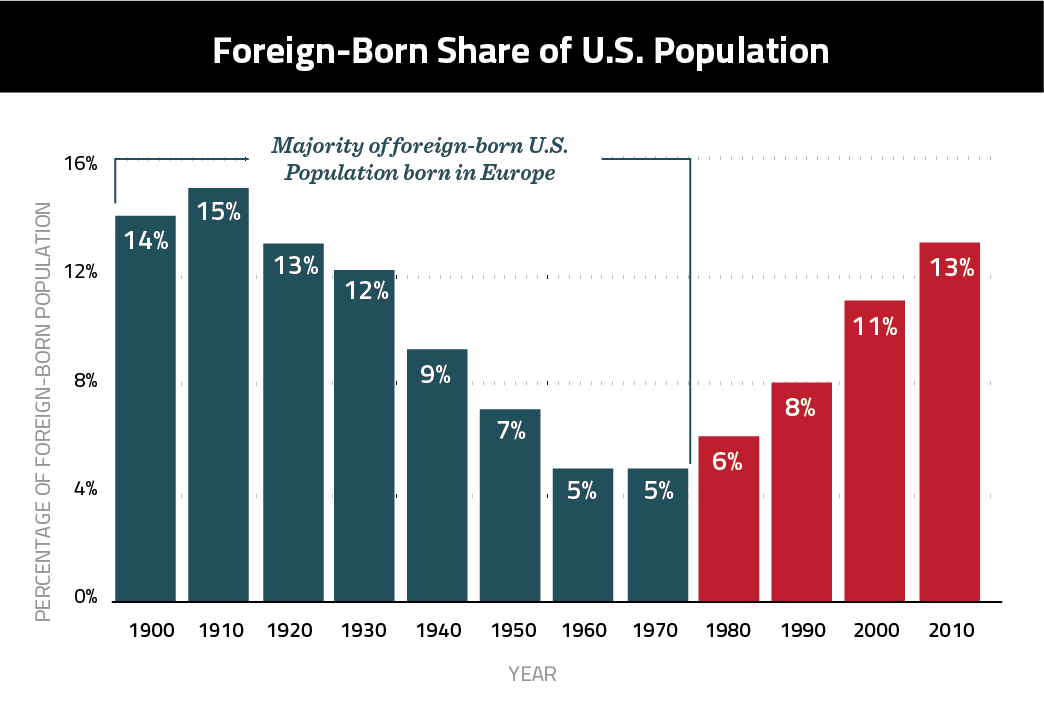

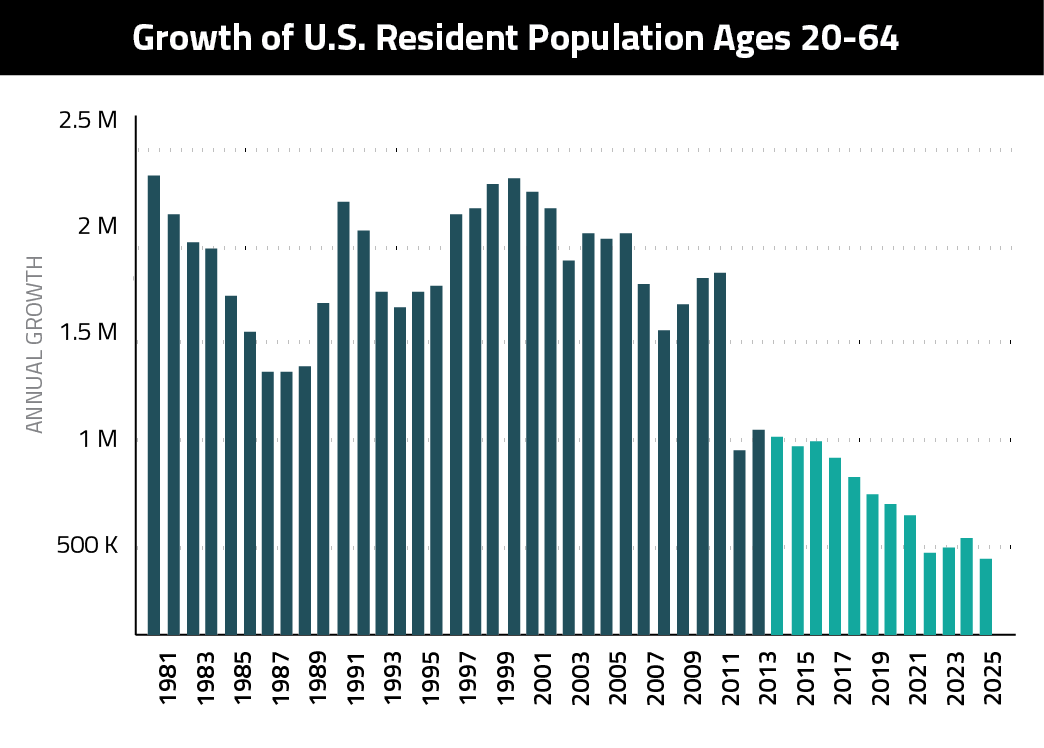

- Population Growth: Areas experiencing population growth will likely see increased demand for housing, potentially driving prices upward.

- Aging Population: As the population ages, demand for senior-friendly housing and assisted living facilities is expected to rise.

- Millennial Homeownership: This generation, now entering its peak home-buying years, is shaping demand for urban and suburban housing with specific preferences for amenities and sustainability.

- Urbanization: The continued movement of people to urban centers can lead to higher property values in these areas, while suburban and rural areas may experience slower growth.

3. Technological Advancements:

- PropTech: The rise of technology in real estate is streamlining processes, improving efficiency, and offering innovative solutions. This includes virtual tours, online platforms for property management, and data-driven insights for investment decisions.

- Smart Homes: The integration of smart technology in homes is increasing demand for energy-efficient and technologically advanced properties.

- Remote Work: The rise of remote work has led to a shift in housing preferences, with some seeking larger spaces outside of traditional urban centers.

4. Environmental Factors:

- Climate Change: The increasing awareness of climate change impacts is influencing housing preferences, with a focus on energy efficiency, resilience, and location considerations.

- Sustainability: Demand for eco-friendly and sustainable homes is growing, driven by environmental concerns and potential cost savings.

The Significance of the real estate market trends graph 2025****

The real estate market trends graph 2025 provides a crucial roadmap for navigating the future of the real estate market. By understanding its projections, stakeholders can:

- Make Informed Investment Decisions: Investors can identify emerging trends and capitalize on potential growth areas, optimizing their portfolio allocation.

- Strategize Market Entry and Exit: Both buyers and sellers can leverage the graph’s insights to determine optimal timing for entering or exiting the market.

- Adapt Business Strategies: Real estate professionals can adapt their services and offerings to meet evolving market demands, staying competitive in a dynamic landscape.

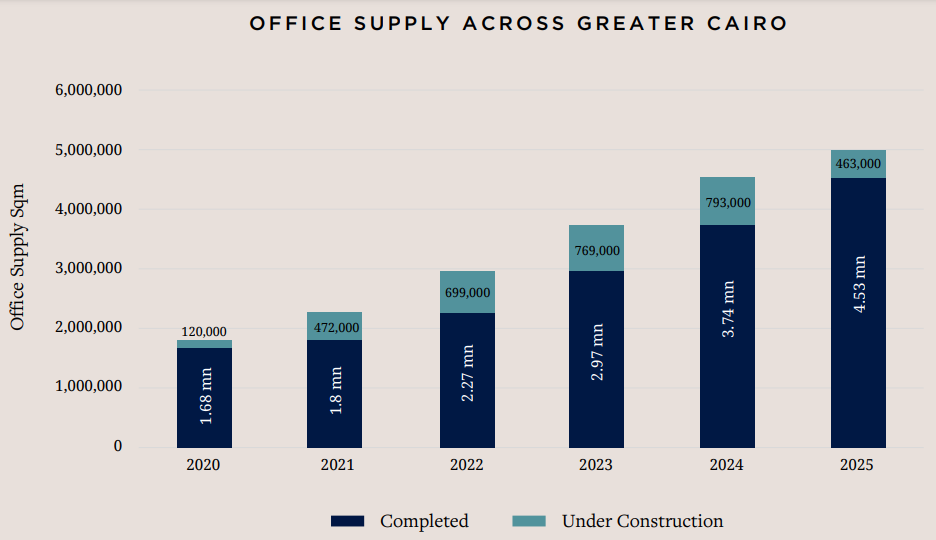

- Plan for Future Development: Developers can use the graph to guide their investment decisions, focusing on areas with projected growth and adapting to changing housing preferences.

- Develop Effective Policy Solutions: Governments can utilize the graph to inform policy decisions, promoting sustainable development, affordability, and equitable access to housing.

Exploring Related Searches

Understanding the real estate market trends graph 2025 necessitates exploring related searches that provide a deeper context and offer valuable insights into specific market segments and trends:

1. Real Estate Market Trends by Region:

- Global Real Estate Trends: This exploration delves into the broader global picture, analyzing major economic regions and their respective market dynamics.

- Regional Market Trends: This focuses on specific geographical areas, such as North America, Europe, Asia, or emerging markets, analyzing their unique characteristics and potential growth drivers.

- City-Specific Market Trends: This provides a granular view of individual cities and their local market dynamics, considering factors like population growth, employment opportunities, and infrastructure development.

2. Housing Market Trends:

- Residential Real Estate Trends: This examines the trends within the residential sector, focusing on single-family homes, apartments, townhouses, and other housing types.

- Commercial Real Estate Trends: This explores the commercial sector, analyzing trends in office spaces, retail properties, industrial facilities, and hospitality venues.

- Luxury Real Estate Trends: This delves into the high-end market, analyzing trends in luxury homes, penthouses, and exclusive properties.

3. Investment Trends in Real Estate:

- Real Estate Investment Strategies: This explores various investment approaches, including buy-and-hold, flipping, rental properties, and REITs (Real Estate Investment Trusts).

- Real Estate Investment Returns: This analyzes historical and projected returns on different real estate investments, helping investors assess potential profitability.

- Real Estate Investment Risks: This identifies potential risks associated with real estate investments, such as market volatility, interest rate fluctuations, and property management challenges.

4. Housing Affordability Trends:

- Housing Affordability Index: This metric measures the affordability of housing in different regions, considering income levels, housing costs, and other factors.

- Housing Affordability Solutions: This explores potential solutions to address affordability issues, such as government subsidies, affordable housing programs, and zoning reforms.

- Impact of Affordability on Housing Demand: This analyzes how affordability constraints can influence housing choices and potentially lead to shifts in demand patterns.

5. Sustainable Real Estate Trends:

- Green Building Standards: This explores the growing adoption of green building certifications, such as LEED (Leadership in Energy and Environmental Design), promoting energy efficiency and sustainable practices.

- Renewable Energy in Housing: This analyzes the integration of solar panels, wind turbines, and other renewable energy sources in residential properties.

- Water Conservation Technologies: This explores the adoption of water-efficient appliances, rainwater harvesting systems, and other technologies to reduce water consumption.

6. Technological Trends in Real Estate:

- PropTech Innovations: This delves into the latest technological advancements in real estate, such as virtual reality tours, online property management platforms, and data analytics tools.

- Artificial Intelligence in Real Estate: This explores the role of AI in property valuation, market analysis, and customer service within the real estate industry.

- Blockchain Technology in Real Estate: This examines the potential of blockchain for secure property transactions, transparent ownership records, and efficient property management.

7. Real Estate Market Forecasts:

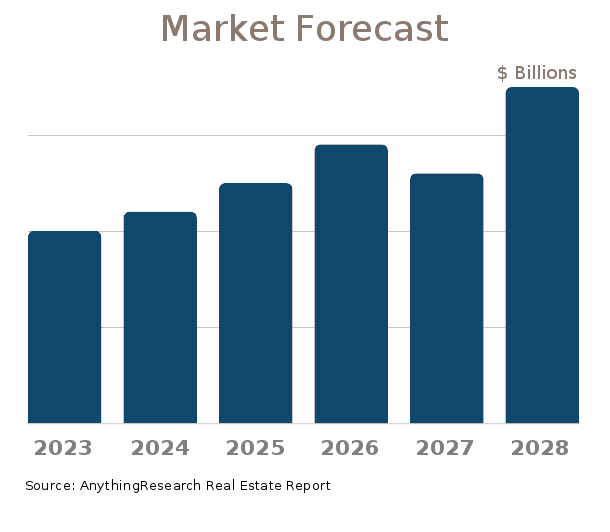

- Real Estate Market Predictions: This provides forecasts for future market performance, including projections for price growth, rental rates, and investment returns.

- Impact of Global Events on Real Estate: This analyzes the potential impact of global events, such as pandemics, political instability, and economic crises, on the real estate market.

- Scenario Planning for Real Estate: This involves creating different scenarios for future market conditions, allowing stakeholders to prepare for various potential outcomes.

8. Real Estate Market Data and Analytics:

- Real Estate Market Data Sources: This identifies reliable sources for real estate data, including government agencies, industry associations, and data analytics companies.

- Real Estate Market Data Analysis: This explores the use of data analytics to identify trends, forecast market performance, and make informed investment decisions.

- Real Estate Market Research and Reports: This provides access to comprehensive market research reports, offering in-depth analysis of specific market segments and trends.

FAQs about the real estate market trends graph 2025****

1. What are the key factors influencing the real estate market trends graph 2025?

The real estate market trends graph 2025 is influenced by a complex interplay of economic, demographic, technological, and environmental factors. These factors are interconnected and can amplify or offset each other, creating a dynamic and unpredictable market landscape.

2. How can the real estate market trends graph 2025 be used to make informed investment decisions?

The real estate market trends graph 2025 can help investors identify potential growth areas and understand the risks associated with different investment strategies. By analyzing the projected trends, investors can allocate their capital more strategically and make informed decisions about property acquisition, development, and asset management.

3. What are the potential challenges associated with the real estate market trends graph 2025?

The real estate market trends graph 2025 is based on current data and assumptions, and it is subject to change as new information emerges and unforeseen events occur. The graph may not accurately predict the impact of unexpected economic shocks, political instability, or technological disruptions.

4. How can the real estate market trends graph 2025 be used to address housing affordability issues?

The real estate market trends graph 2025 can help identify areas where affordability is a major concern and inform policy decisions to address these issues. This may involve promoting affordable housing development, providing financial assistance to low-income homebuyers, and implementing zoning reforms to increase housing supply.

5. How can the real estate market trends graph 2025 be used to promote sustainable development?

The real estate market trends graph 2025 can highlight the growing demand for sustainable housing and guide developers to adopt green building practices, utilize renewable energy sources, and implement water conservation technologies. By integrating sustainability considerations into their projects, developers can contribute to a more environmentally responsible built environment.

Tips for Utilizing the real estate market trends graph 2025****

- Stay Informed: Continuously monitor economic indicators, demographic shifts, technological advancements, and environmental trends to stay abreast of evolving market dynamics.

- Consult with Experts: Seek guidance from experienced real estate professionals, economists, and market analysts to gain deeper insights into the projected trends and their implications.

- Diversify Investments: Spread investments across different property types, locations, and asset classes to mitigate risks and capitalize on diverse growth opportunities.

- Embrace Technology: Utilize PropTech tools and data analytics to improve efficiency, gain competitive advantages, and make more informed decisions.

- Prioritize Sustainability: Consider incorporating sustainability features into your real estate investments, aligning with evolving consumer preferences and contributing to environmental responsibility.

Conclusion

The real estate market trends graph 2025 provides a valuable roadmap for navigating the future of the real estate market. By understanding the key drivers, potential opportunities, and challenges, stakeholders can make informed decisions, adapt their strategies, and position themselves for success in a dynamic and evolving landscape. It is essential to recognize that the graph is a dynamic tool, requiring ongoing analysis and adjustments as market conditions change. By staying informed, embracing innovation, and adapting to emerging trends, stakeholders can effectively leverage the insights of the real estate market trends graph 2025 to navigate the future of real estate with confidence and foresight.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Deep Dive into Real Estate Market Trends Graph 2025. We thank you for taking the time to read this article. See you in our next article!