Navigating the Future: A Look at Natural Gas Price Trends in 2025

Navigating the Future: A Look at Natural Gas Price Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Look at Natural Gas Price Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: A Look at Natural Gas Price Trends in 2025

- 2 Introduction

- 3 Navigating the Future: A Look at Natural Gas Price Trends in 2025

- 3.1 Understanding the Factors Shaping Natural Gas Prices

- 3.2 Analyzing Historical Trends

- 3.3 Predicting Natural Gas Price Trends in 2025

- 3.4 Natural Gas Price Trends in 2025: A Summary

- 3.5 Related Searches

- 3.6 FAQs

- 3.7 Tips

- 3.8 Conclusion

- 4 Closure

Navigating the Future: A Look at Natural Gas Price Trends in 2025

The energy landscape is in constant flux, driven by factors like technological advancements, geopolitical shifts, and evolving environmental concerns. Within this dynamic environment, natural gas price trends stand as a critical indicator, influencing energy policy, investment decisions, and ultimately, the cost of living for individuals and businesses.

Predicting the future of natural gas prices is a complex endeavor, requiring an understanding of intricate market forces and their interplay. While forecasting with absolute certainty is impossible, analyzing historical trends, current market conditions, and potential future drivers can shed light on the likely trajectory of natural gas prices in 2025.

Understanding the Factors Shaping Natural Gas Prices

The price of natural gas is determined by a complex interplay of supply, demand, and various other factors. Some of the key drivers include:

-

Global Supply: The availability of natural gas reserves, production capacity, and geopolitical stability in producing regions significantly influence prices. Increased production in regions like the United States, coupled with the development of new export terminals, has contributed to a global surplus in recent years. However, factors like political instability in key producing nations or disruptions to infrastructure could lead to supply shortages and price spikes.

-

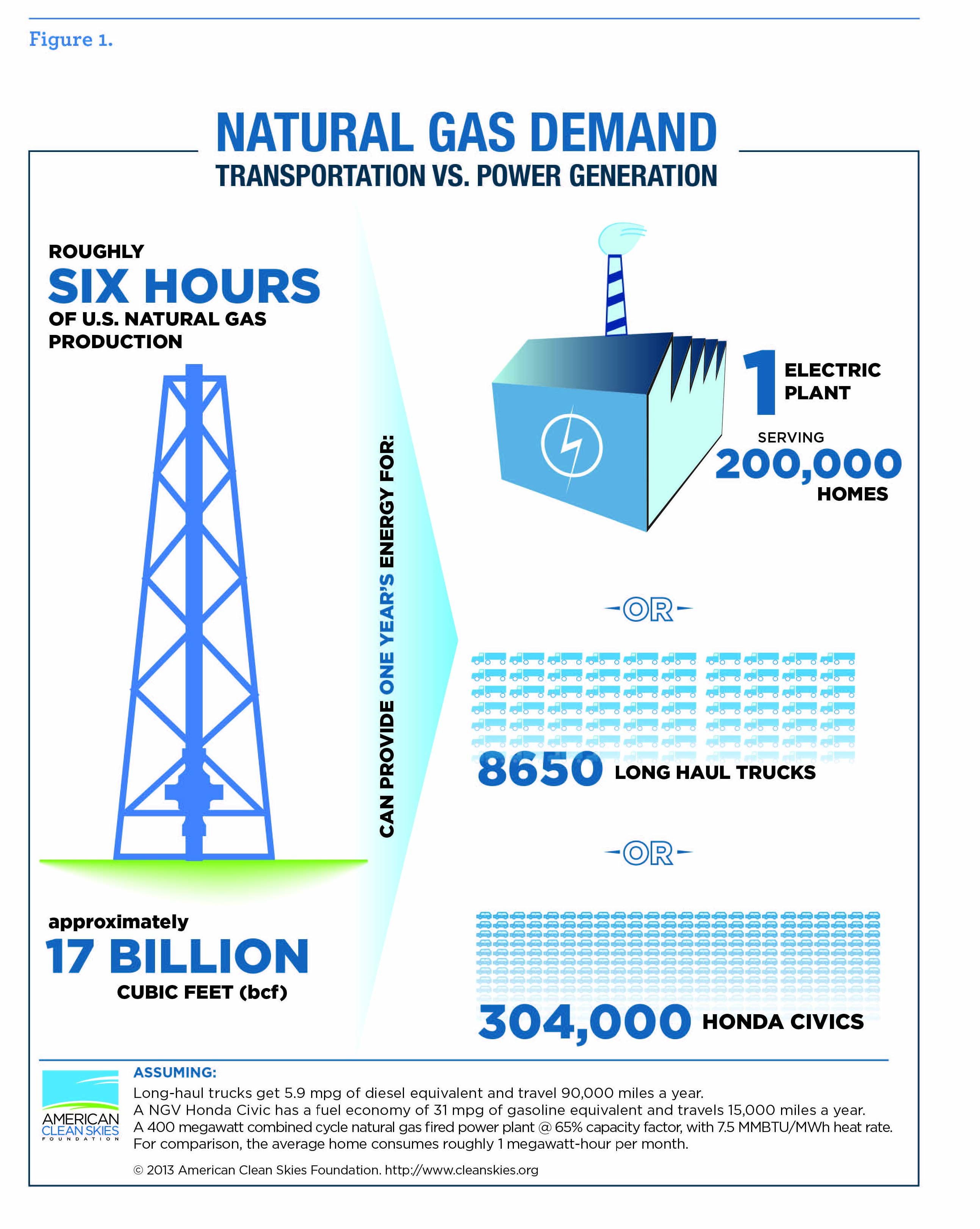

Demand: The demand for natural gas is driven by its use in various sectors, including electricity generation, industrial processes, residential heating, and transportation. As the world transitions towards cleaner energy sources, demand for natural gas is expected to grow, particularly in regions seeking to reduce their reliance on coal.

-

Weather: Seasonal weather patterns play a crucial role in natural gas prices. During colder months, demand for heating increases, driving up prices. Conversely, mild winters can lead to lower prices due to reduced demand.

-

Government Policies: Regulatory frameworks, including environmental regulations, subsidies, and taxes, can influence both supply and demand for natural gas, impacting prices. For instance, policies promoting renewable energy sources may indirectly reduce demand for natural gas, while subsidies for natural gas production can increase supply.

-

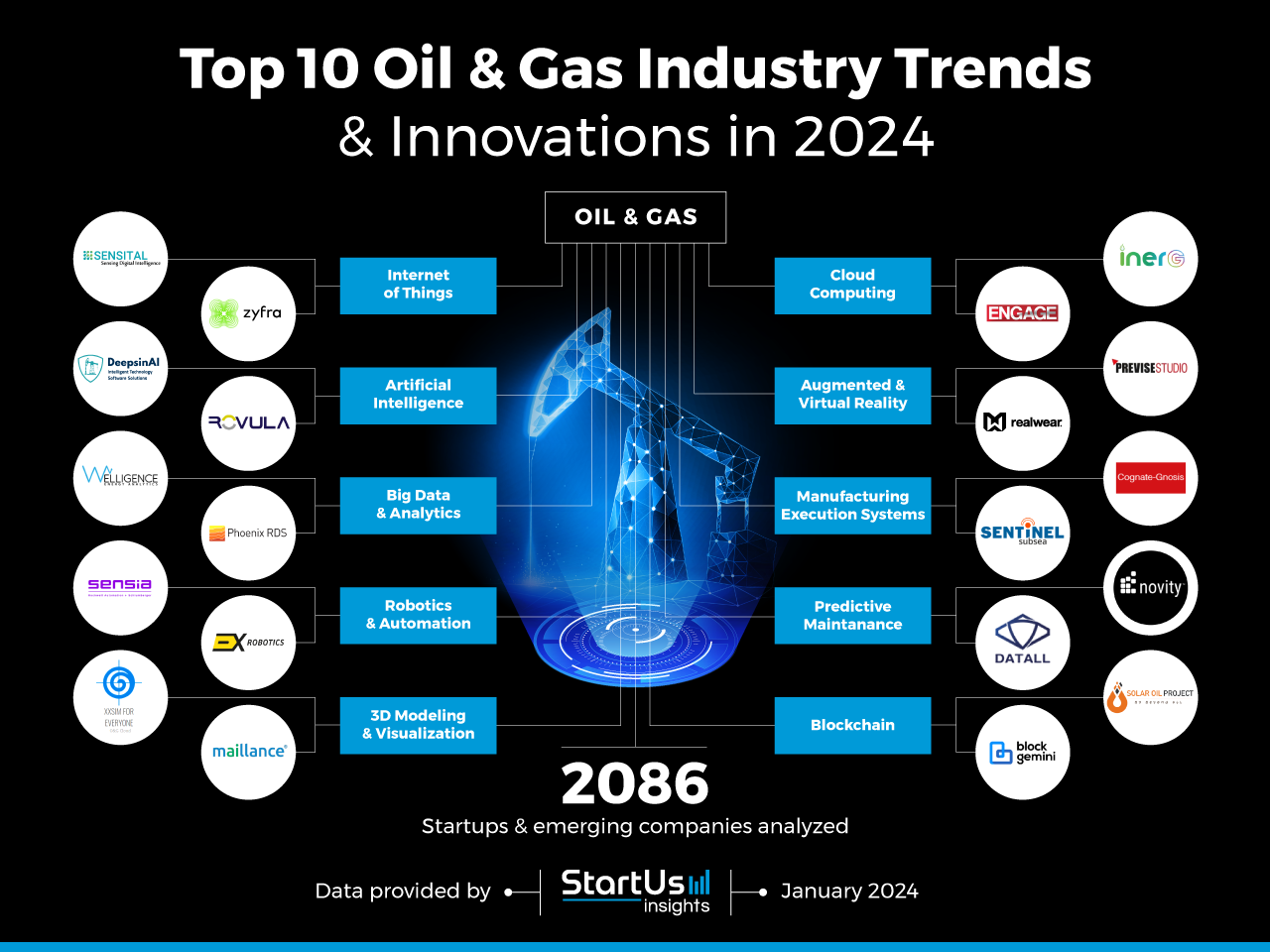

Technological Advancements: Innovations in extraction technologies like fracking have increased natural gas production, leading to lower prices. Similarly, advancements in liquefied natural gas (LNG) technology have facilitated global trade, increasing competition and potentially impacting prices.

-

Economic Conditions: Global economic growth and fluctuations in currency exchange rates can influence demand for natural gas, impacting prices.

Analyzing Historical Trends

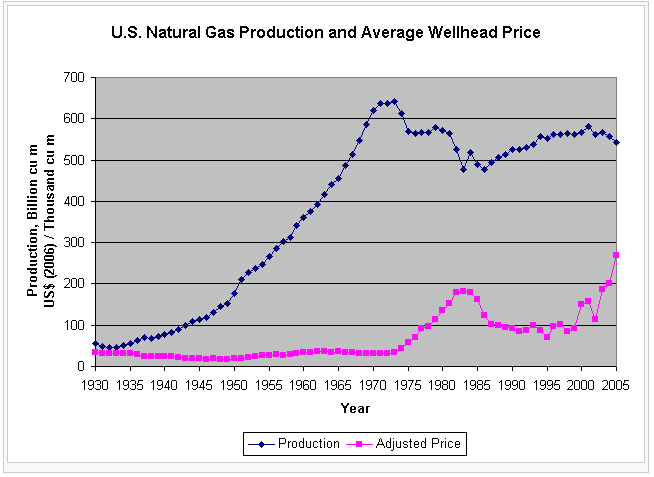

To understand future trends, it’s essential to analyze historical data. Over the past decade, natural gas prices have experienced significant fluctuations, driven by various factors:

-

The Shale Revolution: The rise of hydraulic fracturing (fracking) in the United States led to a surge in natural gas production, resulting in a period of historically low prices. This abundance of supply significantly impacted global markets.

-

Geopolitical Events: Conflicts and sanctions in key producing regions, such as Russia and Iran, have often led to price spikes due to supply disruptions.

-

Energy Transition: The growing demand for cleaner energy sources, coupled with policies promoting renewable energy, has contributed to increased demand for natural gas as a cleaner alternative to coal.

Predicting Natural Gas Price Trends in 2025

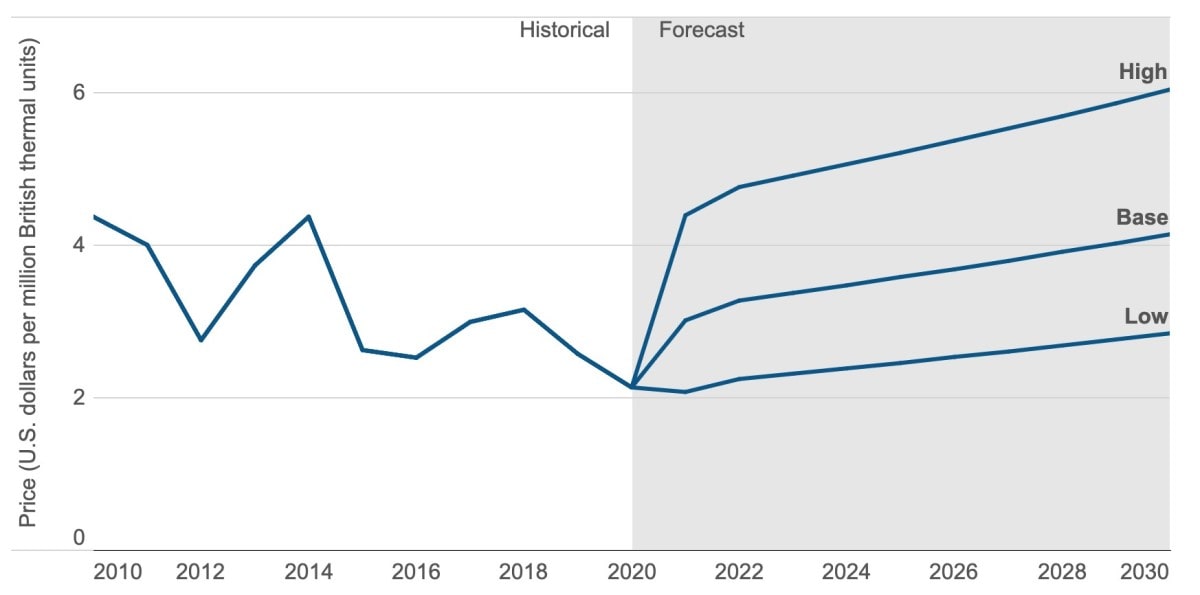

While forecasting the future is inherently uncertain, considering current trends and potential future drivers can offer insights into the likely trajectory of natural gas prices in 2025:

-

Continued Growth in U.S. Production: The United States is expected to remain a major natural gas producer, with continued growth in shale production. This could potentially lead to lower prices, assuming stable political and economic conditions.

-

Global Demand Growth: As the world transitions towards cleaner energy sources, demand for natural gas is expected to increase, particularly in Asia and Europe. This growth could potentially counterbalance the impact of increased U.S. production, leading to price stability or even moderate increases.

-

The Role of LNG: The expansion of global LNG infrastructure is expected to facilitate increased trade, potentially moderating price fluctuations. However, geopolitical tensions and infrastructure constraints could create bottlenecks, leading to price volatility.

-

Technological Advancements: Continued innovation in extraction and transportation technologies could further reduce costs and increase supply, potentially leading to lower prices.

-

Climate Change Mitigation: Governments worldwide are increasingly focusing on climate change mitigation efforts, which could lead to policies promoting natural gas as a cleaner alternative to coal. This could drive up demand and prices.

Natural Gas Price Trends in 2025: A Summary

Based on current trends and potential future drivers, natural gas prices in 2025 are likely to be influenced by:

- Increased U.S. production: Contributing to potential price stability or even lower prices.

- Global demand growth: Potentially counterbalancing the impact of increased supply and driving price stability or moderate increases.

- The role of LNG: Expanding trade and potentially moderating price fluctuations, but also presenting risks of bottlenecks and volatility.

- Technological advancements: Potentially leading to lower costs and increased supply, potentially contributing to lower prices.

- Climate change mitigation efforts: Potentially driving up demand and prices.

The interplay of these factors suggests that natural gas prices in 2025 could range from moderate increases to relative stability, with potential for volatility depending on unforeseen events.

Related Searches

1. Natural Gas Price Forecasts 2025: This search focuses on specific predictions and forecasts for natural gas prices in 2025, often provided by industry analysts, research institutions, and government agencies. These forecasts typically incorporate various factors, including supply and demand projections, economic trends, and geopolitical risks.

2. Natural Gas Price Volatility: Exploring the factors contributing to price fluctuations in the natural gas market, including seasonal demand, geopolitical events, and supply disruptions. This search delves into the mechanisms that drive price swings and their impact on energy markets.

3. Natural Gas Price Outlook: This broader search explores the overall future trajectory of natural gas prices, considering long-term trends and potential disruptions. It examines the factors influencing price dynamics over a longer timeframe, including technological advancements, environmental regulations, and global economic conditions.

4. Natural Gas Price History: This search delves into historical data on natural gas prices, providing insights into past trends and fluctuations. Examining historical price movements can help identify recurring patterns and assess the impact of various events on market dynamics.

5. Natural Gas Price Analysis: This search focuses on analyzing the factors influencing natural gas prices, including supply and demand dynamics, economic conditions, and geopolitical events. It often involves quantitative analysis, statistical modeling, and expert opinions to provide a comprehensive understanding of market forces.

6. Natural Gas Price Correlation: This search explores the relationships between natural gas prices and other factors, such as oil prices, economic indicators, and weather patterns. Understanding these correlations can provide insights into how external factors impact natural gas prices.

7. Natural Gas Price Impact on Economy: This search examines the economic consequences of fluctuations in natural gas prices, including their impact on consumer spending, industrial production, and overall economic growth. It analyzes the ripple effects of price changes across various sectors.

8. Natural Gas Price Regulation: This search focuses on government policies and regulations related to natural gas prices, including pricing mechanisms, subsidies, and environmental regulations. It explores how regulatory frameworks influence market dynamics and price stability.

FAQs

1. What are the main factors influencing natural gas prices in 2025?

The primary factors influencing natural gas prices in 2025 include:

- Global supply and demand: The balance between production and consumption will play a crucial role in determining price levels.

- Technological advancements: Innovations in extraction and transportation technologies could influence supply and costs.

- Geopolitical events: Conflicts or disruptions in key producing regions can lead to supply shortages and price spikes.

- Climate change mitigation efforts: Policies promoting cleaner energy sources could impact demand and prices.

2. How will the growth of renewable energy impact natural gas prices?

The growth of renewable energy sources like solar and wind could have both positive and negative impacts on natural gas prices. On the one hand, increased renewable energy production might reduce demand for natural gas, leading to lower prices. On the other hand, natural gas could be used as a complementary source to provide backup power for renewable energy systems, potentially increasing demand and prices.

3. What is the role of liquefied natural gas (LNG) in influencing natural gas prices?

LNG plays a significant role in global natural gas trade, allowing for the transportation of gas across oceans. The expansion of LNG infrastructure and increased trade could potentially moderate price fluctuations by increasing competition and diversifying supply sources. However, bottlenecks in LNG infrastructure or geopolitical tensions could lead to price volatility.

4. How can consumers and businesses prepare for potential fluctuations in natural gas prices?

Consumers and businesses can mitigate the impact of price fluctuations by:

- Improving energy efficiency: Reducing energy consumption through measures like insulation, efficient appliances, and behavioral changes can minimize the impact of higher prices.

- Locking in fixed-price contracts: Negotiating long-term contracts with suppliers at fixed prices can provide protection against price increases.

- Diversifying energy sources: Utilizing multiple energy sources, such as renewable energy or alternative fuels, can reduce dependence on natural gas and mitigate price fluctuations.

5. What are the potential risks and opportunities associated with natural gas price trends in 2025?

Potential risks associated with natural gas price trends in 2025 include:

- Geopolitical instability: Conflicts or disruptions in key producing regions could lead to supply shortages and price spikes.

- Technological disruptions: Rapid advancements in alternative energy technologies could lead to a decline in demand for natural gas, impacting prices.

- Environmental regulations: Stringent environmental regulations could increase production costs, potentially leading to higher prices.

Potential opportunities associated with natural gas price trends in 2025 include:

- Increased demand: The growing demand for natural gas as a cleaner alternative to coal could create opportunities for investment in production and infrastructure.

- Technological advancements: Innovations in extraction and transportation technologies could lead to lower production costs and increased efficiency.

- Global trade: The expansion of LNG trade could create opportunities for new markets and investment.

Tips

- Stay informed about market trends: Regularly monitor news and industry reports to stay informed about factors influencing natural gas prices.

- Analyze historical data: Examine historical price movements to identify recurring patterns and understand the impact of past events.

- Consider hedging strategies: Explore hedging options, such as futures contracts, to mitigate price risks.

- Improve energy efficiency: Implement measures to reduce energy consumption and minimize the impact of price increases.

- Diversify energy sources: Explore alternative energy sources to reduce dependence on natural gas.

Conclusion

Predicting natural gas price trends in 2025 requires navigating a complex web of factors, including global supply and demand, technological advancements, geopolitical events, and climate change mitigation efforts. While forecasting with absolute certainty is impossible, understanding the interplay of these forces can provide valuable insights into the potential trajectory of prices.

The future of natural gas prices is likely to be characterized by a mix of stability and volatility, influenced by both anticipated and unforeseen events. By remaining informed about market dynamics, exploring hedging strategies, and embracing energy efficiency measures, consumers and businesses can navigate the evolving landscape of natural gas prices and make informed decisions to mitigate risks and seize opportunities.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Look at Natural Gas Price Trends in 2025. We appreciate your attention to our article. See you in our next article!