Navigating the Future: M&A Trends in 2025

Navigating the Future: M&A Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: M&A Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: M&A Trends in 2025

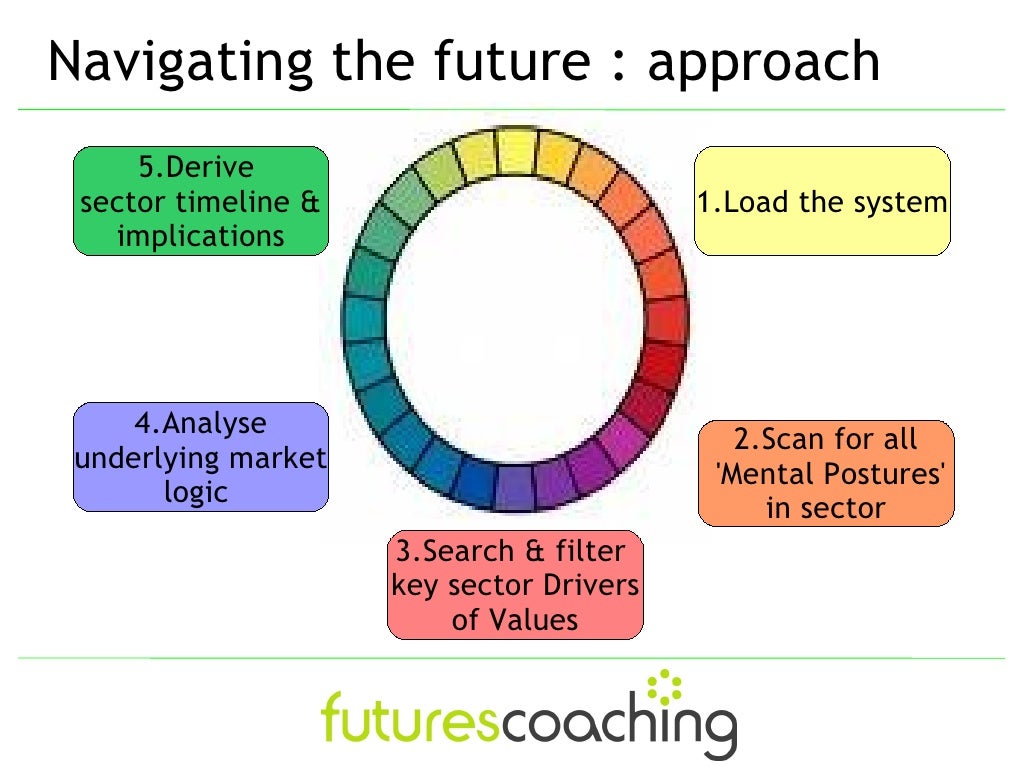

The landscape of mergers and acquisitions (M&A) is constantly evolving, driven by technological advancements, economic shifts, and changing market dynamics. As we look towards 2025, several key trends are expected to shape the M&A landscape, presenting both opportunities and challenges for businesses.

1. The Rise of Strategic Acquisitions:

- Focus on Innovation and Growth: Businesses will prioritize acquisitions that bolster their core competencies, enhance their technological capabilities, and open up new markets. This strategic approach aims to accelerate growth and gain a competitive edge.

- Vertical Integration and Supply Chain Optimization: Companies will seek to acquire businesses within their value chain, aiming for greater control over resources, production, and distribution. This vertical integration strategy helps mitigate supply chain vulnerabilities and enhance operational efficiency.

- Expansion into Emerging Markets: As global economies evolve, companies will increasingly look to expand their reach into emerging markets through strategic acquisitions. This allows them to tap into new customer segments and capitalize on growth opportunities in dynamic regions.

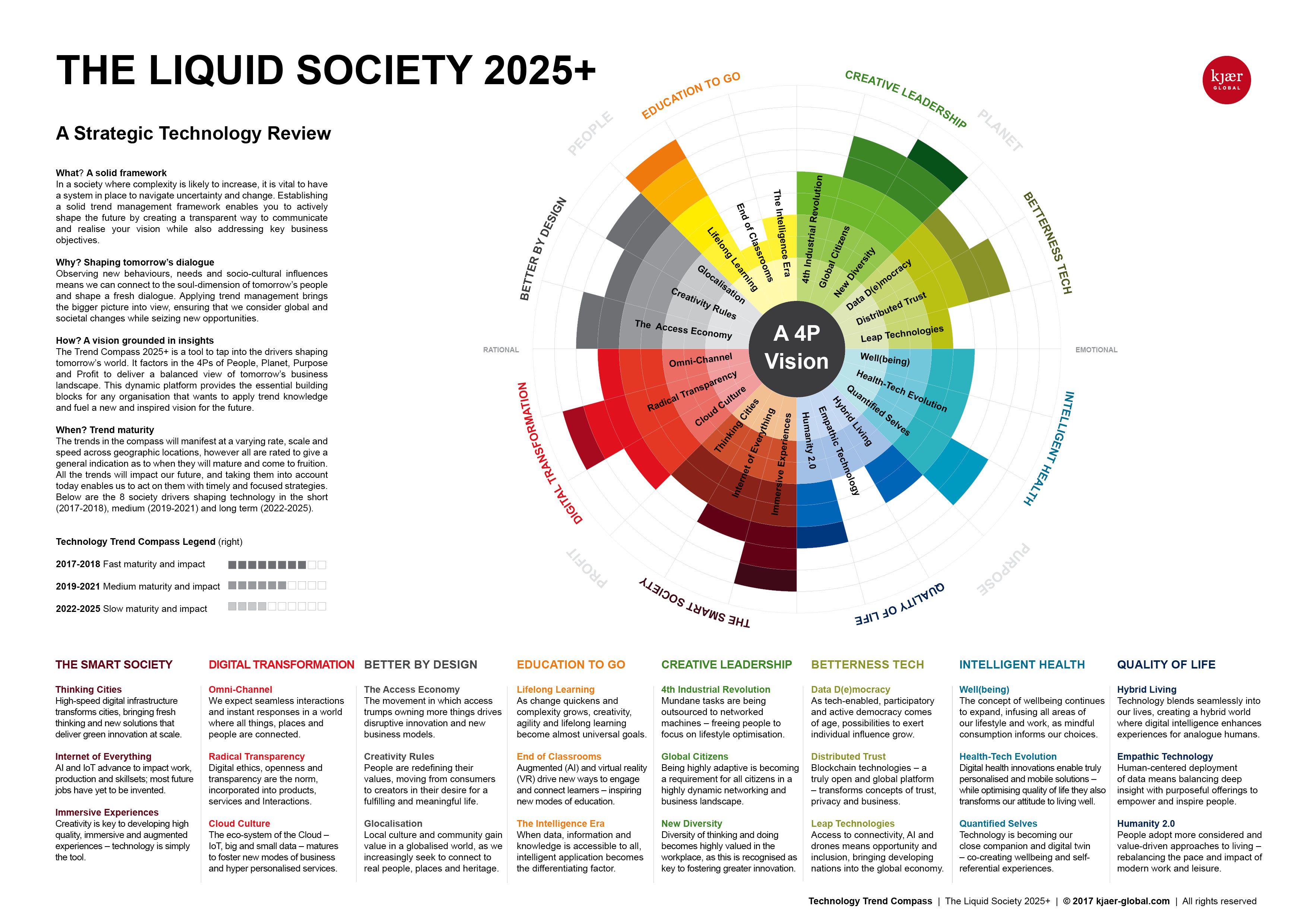

2. The Impact of Technology on M&A:

- Digital Transformation and Cloud Adoption: The widespread adoption of cloud computing and digital technologies will influence M&A activity. Companies seeking to enhance their digital capabilities will actively pursue acquisitions of technology companies or businesses with advanced digital infrastructure.

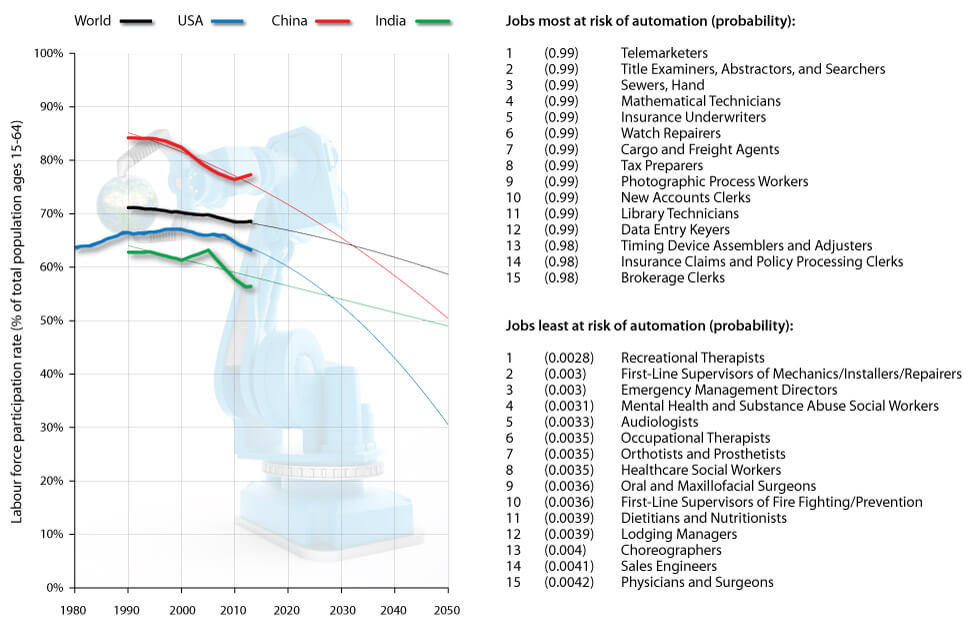

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are rapidly transforming industries, and businesses will seek to acquire companies with expertise in these areas. This will enable them to leverage AI-powered solutions for enhanced decision-making, automation, and customer engagement.

- Cybersecurity and Data Privacy: As cybersecurity threats become more sophisticated, companies will prioritize acquisitions of businesses specializing in cybersecurity and data privacy. This will help them safeguard their digital assets and comply with evolving regulatory landscapes.

3. The Growing Importance of ESG Factors:

- Environmental, Social, and Governance (ESG) considerations: Investors and stakeholders are increasingly emphasizing ESG factors in their decision-making. Companies will focus on acquiring businesses that align with their ESG commitments, demonstrating a commitment to sustainability, social responsibility, and good governance.

- Sustainable Business Practices: Acquisitions will be driven by a focus on sustainable business practices, such as renewable energy solutions, circular economy models, and ethical sourcing. Companies will prioritize businesses that contribute to a more sustainable future.

- Diversity and Inclusion: M&A activity will reflect a greater emphasis on diversity and inclusion. Companies will seek to acquire businesses with diverse leadership and workforce demographics, promoting a more inclusive and equitable business environment.

4. The Influence of Geopolitical Factors:

- Trade Wars and Protectionist Policies: Global trade tensions and protectionist policies will influence M&A activity. Companies may consider acquisitions within their domestic markets or regions with favorable trade agreements to mitigate risks associated with international trade.

- Political Instability and Economic Uncertainty: Political instability and economic uncertainty can impact M&A decisions. Companies will carefully evaluate geopolitical risks and economic conditions before engaging in acquisitions.

- Government Regulations and Antitrust Scrutiny: M&A transactions will face increased scrutiny from regulatory authorities. Companies will need to navigate complex legal and regulatory frameworks to ensure successful deal execution.

5. The Rise of Private Equity:

- Increased Private Equity Activity: Private equity firms are expected to play a more active role in M&A, seeking to acquire businesses with strong growth potential and capitalize on market opportunities.

- Focus on Leveraged Buyouts: Private equity firms will continue to utilize leveraged buyouts (LBOs) to finance acquisitions, leveraging debt to acquire businesses and generate returns for their investors.

- Consolidation and Restructuring: Private equity firms will also focus on consolidating fragmented industries and restructuring businesses to enhance efficiency and profitability.

6. The Role of Digital M&A Platforms:

- Streamlined Deal Processes: Digital M&A platforms are emerging to facilitate and streamline deal processes, providing access to a wider pool of potential buyers and sellers.

- Data Analytics and Valuation Tools: These platforms offer advanced data analytics and valuation tools to support deal negotiations and improve deal outcomes.

- Enhanced Transparency and Efficiency: Digital platforms promote greater transparency and efficiency in M&A transactions, enabling faster and more effective deal execution.

7. The Importance of Deal Structuring:

- Creative Deal Structures: Companies will explore creative deal structures to overcome challenges and enhance deal attractiveness. This includes joint ventures, carve-outs, and strategic alliances.

- Flexible Payment Options: Flexible payment options, such as earn-out agreements and deferred payments, will be employed to mitigate risks and align incentives between buyer and seller.

- Focus on Integration: Companies will prioritize successful integration planning to ensure a smooth transition and maximize value creation post-acquisition.

8. The Future of M&A:

- Increased Focus on Value Creation: Companies will increasingly focus on creating long-term value through M&A, moving beyond short-term gains. This involves identifying synergistic opportunities and fostering a culture of integration.

- Importance of Cultural Fit: Companies will prioritize cultural fit during the acquisition process, ensuring that the acquired business aligns with their values and operating principles.

- Technological Advancements: Technological advancements will continue to reshape the M&A landscape, driving innovation and creating new opportunities for growth and value creation.

Related Searches:

- M&A Trends in Specific Industries: Understanding the specific M&A trends in industries like healthcare, technology, and energy can provide valuable insights for businesses operating in those sectors.

- M&A Strategies for Small and Medium-Sized Enterprises (SMEs): SMEs can benefit from tailored M&A strategies to achieve growth and expansion.

- M&A Due Diligence and Valuation: Conducting thorough due diligence and accurate valuation are crucial for successful M&A transactions.

- M&A Legal and Regulatory Considerations: Navigating complex legal and regulatory frameworks is essential for smooth deal execution.

- M&A Integration and Post-Merger Management: Effective integration planning and post-merger management are critical for maximizing value creation.

- M&A Exit Strategies: Understanding different exit strategies for M&A transactions is important for achieving desired outcomes.

- M&A Technology and Tools: Exploring available technology and tools can streamline M&A processes and improve deal outcomes.

- M&A Case Studies and Best Practices: Learning from successful M&A case studies and best practices can provide valuable guidance for future transactions.

FAQs about M&A Trends in 2025:

Q: What are the biggest challenges facing M&A in 2025?

A: Challenges include geopolitical uncertainty, economic volatility, regulatory scrutiny, and the need for successful integration.

Q: How will technology influence M&A in the future?

A: Technology will enable more efficient deal processes, provide access to data-driven insights, and drive innovation in M&A strategies.

Q: What are the key considerations for successful M&A integration?

A: Successful integration requires careful planning, cultural alignment, effective communication, and a focus on value creation.

Q: How can businesses prepare for M&A Trends in 2025?

A: Businesses should stay informed about industry trends, develop a clear M&A strategy, build strong relationships with potential partners, and invest in technology to enhance deal execution.

Tips for Navigating M&A Trends in 2025:

- Embrace Digital Transformation: Invest in technology to streamline deal processes, enhance due diligence, and gain a competitive edge.

- Prioritize ESG Factors: Integrate ESG considerations into M&A strategy, aligning with investor and stakeholder expectations.

- Focus on Value Creation: Move beyond short-term gains and prioritize long-term value creation through strategic acquisitions.

- Build a Strong Team: Assemble a skilled team with expertise in M&A, finance, legal, and integration.

- Stay Informed and Adaptable: Continuously monitor industry trends, adapt to changing market dynamics, and refine M&A strategies accordingly.

Conclusion:

The M&A Trends in 2025 will be shaped by technological advancements, evolving economic landscapes, and a growing emphasis on sustainability and social responsibility. Businesses that embrace these trends, adapt to changing market conditions, and prioritize value creation will be well-positioned to navigate the dynamic M&A landscape and achieve sustainable growth. By understanding the forces shaping the future of M&A, businesses can make informed decisions, capitalize on opportunities, and navigate the challenges ahead.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: M&A Trends in 2025. We appreciate your attention to our article. See you in our next article!