Navigating the Future: Property and Casualty Insurance Industry Trends 2025-2026

Navigating the Future: Property and Casualty Insurance Industry Trends 2025-2026

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Property and Casualty Insurance Industry Trends 2025-2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Property and Casualty Insurance Industry Trends 2025-2026

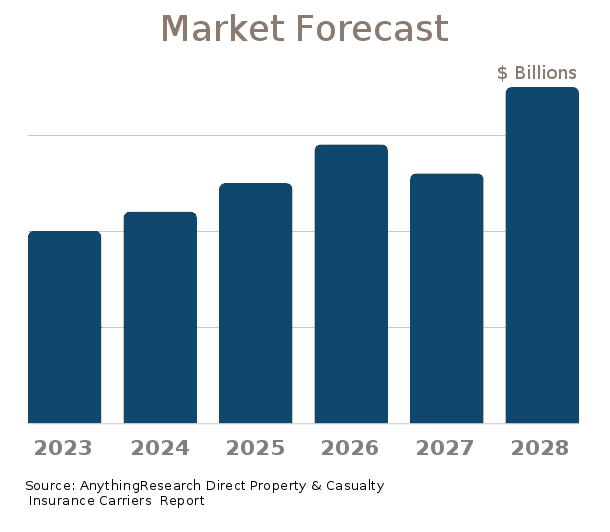

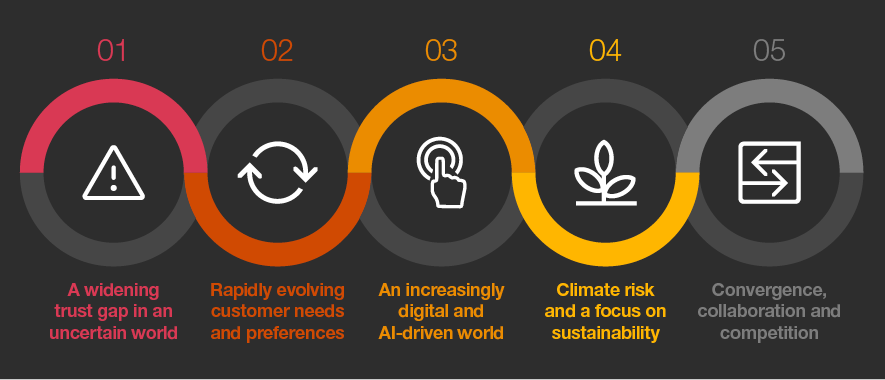

The property and casualty (P&C) insurance industry is undergoing a period of rapid transformation, driven by evolving consumer demands, technological advancements, and a shifting risk landscape. As we look towards 2025-2026, several key trends will shape the industry’s trajectory, influencing the way insurers operate, how consumers interact with insurance, and the overall landscape of risk management.

Understanding the Dynamics of Change

The P&C insurance industry is not immune to the forces reshaping the global economy. The convergence of factors like climate change, technological disruption, and evolving consumer expectations is creating a dynamic environment where adaptability and innovation are critical for survival and success.

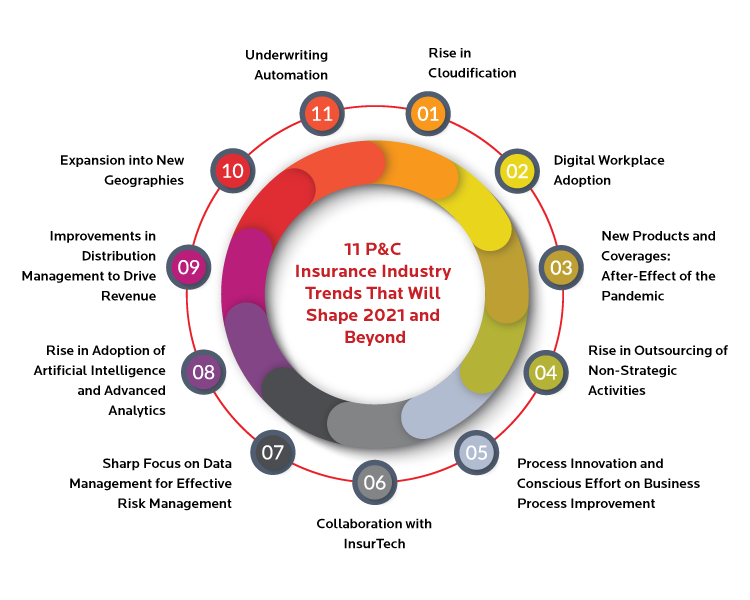

Key Trends Shaping the Future of P&C Insurance

1. Digital Transformation and Insurtech:

- The Rise of Digital Insurance: Consumers are increasingly comfortable with digital interactions and expect seamless online experiences. P&C insurers are responding by investing in digital platforms, mobile applications, and online portals to enhance customer engagement, streamline policy acquisition, and simplify claim processing.

- Insurtech Disruption: Start-ups specializing in insurance technology (insurtech) are disrupting traditional insurance models. These companies leverage data analytics, artificial intelligence (AI), and other advanced technologies to offer innovative solutions, personalized pricing, and faster claims processing. This competition forces established insurers to adapt and embrace new technologies to remain competitive.

- Data-Driven Insights: Insurtech companies are using data analytics to gain deeper insights into customer behavior, risk profiles, and market trends. This data-driven approach allows for more accurate risk assessment, personalized pricing, and improved fraud detection.

2. Climate Change and Extreme Weather Events:

- Increased Risk Exposure: Climate change is leading to more frequent and severe weather events, increasing the likelihood of property damage and financial losses. Insurers are facing rising claims costs and struggling to accurately assess and price risks in a rapidly changing environment.

- Climate Risk Modeling: Advanced climate models are being used to predict the frequency and severity of extreme weather events, enabling insurers to better understand and manage their exposure to climate-related risks.

- Climate-Resilient Solutions: Insurers are developing innovative solutions to mitigate climate risks, including offering discounts for climate-friendly practices, providing guidance on risk mitigation strategies, and partnering with organizations promoting sustainable development.

3. Cybersecurity and Data Privacy:

- Growing Cyber Risk: Cyberattacks are becoming increasingly sophisticated and frequent, targeting individuals, businesses, and insurance companies alike. Data breaches can result in significant financial losses, reputational damage, and regulatory penalties.

- Cybersecurity Investments: P&C insurers are investing heavily in cybersecurity measures to protect their systems, data, and customer information. This includes implementing robust firewalls, intrusion detection systems, and data encryption protocols.

- Data Privacy Regulations: The growing emphasis on data privacy is leading to stricter regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Insurers must comply with these regulations to ensure the responsible handling of customer data.

4. Personalized Insurance and Customer Experience:

- Tailored Coverage: Consumers are demanding more personalized insurance solutions that cater to their specific needs and risk profiles. Insurers are using data analytics and AI to develop customized policies, pricing, and coverage options.

- Enhanced Customer Service: P&C insurers are focusing on improving customer service through digital channels, proactive communication, and personalized support. This includes offering online chatbots, mobile app support, and personalized claim assistance.

- Customer-Centric Approach: The industry is shifting towards a more customer-centric approach, where customer satisfaction and loyalty are prioritized. Insurers are actively seeking feedback, investing in customer relationship management (CRM) systems, and providing tailored experiences.

5. Emerging Technologies and Innovation:

- Artificial Intelligence (AI): AI is transforming the P&C insurance industry by automating tasks, improving risk assessment, and enhancing fraud detection. AI-powered chatbots are providing 24/7 customer support, and AI algorithms are being used to analyze vast amounts of data to identify patterns and trends.

- Internet of Things (IoT): IoT devices are generating real-time data on property conditions, driver behavior, and other risk factors. Insurers are leveraging this data to develop usage-based insurance policies, offer discounts for safe driving habits, and provide proactive risk mitigation advice.

- Blockchain Technology: Blockchain technology is being explored for its potential to streamline insurance processes, improve data security, and facilitate faster claim settlements. It can also be used to create secure and transparent records of insurance transactions.

6. Regulation and Compliance:

- Evolving Regulatory Landscape: The P&C insurance industry is subject to a complex and evolving regulatory environment. New regulations are being introduced to address emerging risks, protect consumers, and ensure market stability.

- Compliance Challenges: Insurers must navigate a complex web of regulations, including those related to data privacy, cybersecurity, and climate change. Compliance with these regulations is crucial to avoid penalties and maintain a strong reputation.

- Regulatory Technology (RegTech): RegTech solutions are being developed to help insurers manage regulatory compliance more effectively. These solutions can automate compliance processes, streamline reporting, and provide real-time insights into regulatory changes.

7. Talent and Workforce Development:

- Skills Gap: The P&C insurance industry is facing a skills gap, particularly in areas like data analytics, cybersecurity, and digital marketing. Attracting and retaining talent with these skills is crucial for innovation and growth.

- Diversity and Inclusion: Creating a more diverse and inclusive workforce is essential for attracting and retaining top talent. Insurers are implementing programs to promote diversity and inclusion at all levels of the organization.

- Upskilling and Reskilling: Insurers are investing in training and development programs to upskill and reskill their workforce to meet the demands of a rapidly changing industry. This includes providing opportunities for employees to learn new skills and adapt to emerging technologies.

8. Mergers and Acquisitions (M&A):

- Industry Consolidation: The P&C insurance industry is experiencing a wave of mergers and acquisitions, driven by factors like increased competition, the need for scale, and the desire to gain access to new technologies and markets.

- Strategic Acquisitions: Insurers are acquiring smaller companies and start-ups to gain access to innovative technologies, expand their product offerings, and enhance their capabilities. These acquisitions are helping to drive innovation and accelerate digital transformation.

- Global Expansion: Insurers are looking to expand their reach into new markets, particularly in emerging economies. M&A activity is playing a key role in facilitating this global expansion.

Related Searches:

- Insurtech Trends: Exploring the latest trends in insurance technology, including AI, blockchain, and IoT.

- Digital Insurance Trends: Analyzing the growth of digital insurance channels and the impact on customer engagement.

- Climate Change and Insurance: Examining the challenges and opportunities posed by climate change for the P&C insurance industry.

- Cybersecurity in Insurance: Understanding the evolving threat landscape and the importance of cybersecurity investments for insurers.

- Data Analytics in Insurance: Exploring how data analytics is transforming risk assessment, pricing, and customer segmentation.

- Customer Experience in Insurance: Examining the importance of customer experience and how insurers are adapting to meet evolving customer expectations.

- Regulation and Compliance in Insurance: Analyzing the impact of regulatory changes on the P&C insurance industry.

- Future of Insurance: Predicting the long-term trends and potential disruptions that will shape the insurance industry in the coming years.

FAQs about Property and Casualty Insurance Industry Trends 2025-2026

Q1: How will climate change impact the P&C insurance industry?

A1: Climate change is a significant driver of change for the P&C insurance industry. It is leading to more frequent and severe weather events, increasing the likelihood of property damage and financial losses. Insurers are facing rising claims costs and struggling to accurately assess and price risks in a rapidly changing environment.

Q2: What role will technology play in the future of insurance?

A2: Technology will play a transformative role in the P&C insurance industry. Insurtech companies are disrupting traditional models with data analytics, AI, and other advanced technologies. Established insurers are embracing these technologies to enhance customer engagement, streamline operations, and improve risk management.

Q3: How will the insurance industry adapt to changing customer expectations?

A3: The insurance industry is adapting to changing customer expectations by embracing digital channels, offering personalized solutions, and prioritizing customer service. Insurers are investing in digital platforms, mobile apps, and data analytics to provide tailored experiences and enhance customer satisfaction.

Q4: What are the biggest challenges facing the P&C insurance industry?

A4: The P&C insurance industry faces several challenges, including climate change, cybersecurity threats, regulatory complexity, and talent shortages. Insurers must adapt to these challenges to remain competitive and sustainable.

Q5: What are the key opportunities for growth in the P&C insurance industry?

A5: The P&C insurance industry has several opportunities for growth, including expanding into new markets, developing innovative products, and leveraging emerging technologies. Insurers that embrace innovation and adapt to changing market conditions are well-positioned for success.

Tips for P&C Insurance Companies Navigating the Future

- Embrace Digital Transformation: Invest in digital platforms, mobile applications, and online portals to enhance customer engagement and streamline operations.

- Leverage Data Analytics and AI: Use data analytics and AI to gain deeper insights into customer behavior, risk profiles, and market trends.

- Focus on Customer Experience: Prioritize customer satisfaction by providing personalized solutions, enhanced customer service, and a seamless digital experience.

- Invest in Cybersecurity: Implement robust cybersecurity measures to protect systems, data, and customer information from cyberattacks.

- Stay Ahead of Regulatory Changes: Monitor regulatory developments and ensure compliance with data privacy, cybersecurity, and other relevant regulations.

- Develop a Diverse and Inclusive Workforce: Attract and retain talent with the skills needed to thrive in a rapidly changing industry.

- Embrace Innovation: Explore new technologies and business models to develop innovative products and services.

Conclusion:

The property and casualty insurance industry is at a crossroads, facing both challenges and opportunities. By embracing digital transformation, leveraging data analytics, and prioritizing customer experience, P&C insurers can navigate the evolving landscape and position themselves for success. The future of the industry lies in adapting to changing consumer demands, embracing new technologies, and proactively managing the risks of a dynamic and uncertain world. The trends outlined above are just a glimpse into the future of P&C insurance. By understanding these trends and adapting accordingly, insurers can ensure their long-term sustainability and continue to play a vital role in protecting individuals and businesses from financial losses.

/property-and-casualty-insurance-market-in-usa---growth,-trends,-and-forecast-(2019---2025)_t1.webp)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Property and Casualty Insurance Industry Trends 2025-2026. We thank you for taking the time to read this article. See you in our next article!