Navigating the Landscape: Mortgage Rate Trends This Week 2025

Navigating the Landscape: Mortgage Rate Trends This Week 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape: Mortgage Rate Trends This Week 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Mortgage Rate Trends This Week 2025

Predicting the future is a tricky business, especially when it comes to financial markets. However, understanding the forces that influence mortgage rate trends this week 2025 can provide valuable insights for prospective homebuyers and current homeowners alike. This analysis delves into the key factors shaping the current mortgage landscape, offering a comprehensive overview of the potential trajectory of rates.

The Economic Undercurrents

The Federal Reserve’s monetary policy is a primary driver of interest rates. The Fed’s actions, particularly around setting the federal funds rate, directly impact the cost of borrowing money, including mortgages. In 2025, the Fed’s stance on inflation will be crucial. If inflation remains stubbornly high, the Fed may continue to raise interest rates, potentially pushing mortgage rates higher. Conversely, if inflation cools down, the Fed might pivot towards easing monetary policy, potentially leading to lower mortgage rates.

Inflation’s Role

Inflation, a persistent increase in the general price level of goods and services, exerts a significant influence on mortgage rates. When inflation is high, lenders demand higher interest rates to compensate for the erosion of their purchasing power. The Consumer Price Index (CPI), a key indicator of inflation, will be closely watched in 2025. If the CPI shows signs of slowing down, it could provide some relief for mortgage rates.

The Global Economic Context

The global economic environment also plays a role in shaping mortgage rate trends. Factors such as international trade tensions, geopolitical instability, and global economic growth can impact investor sentiment, influencing the cost of borrowing. In 2025, the ongoing war in Ukraine and its impact on global supply chains, as well as the economic recovery in China, will be factors to consider.

Government Policies and Regulations

Government policies, such as tax incentives for homeownership or regulations affecting the housing market, can have an impact on mortgage rates. In 2025, any changes to housing finance regulations, such as those related to loan qualifications or the availability of government-backed mortgages, could influence mortgage rates.

The Housing Market Dynamics

The supply and demand dynamics within the housing market itself can also influence mortgage rates. A shortage of available homes for sale can drive up prices, potentially leading to higher demand for mortgages and higher rates. Conversely, a surplus of homes for sale could put downward pressure on prices and potentially lower mortgage rates.

Understanding the Impact: Why These Trends Matter

- Homebuyers: For those seeking to purchase a home, understanding mortgage rate trends this week 2025 is crucial. Higher rates increase the cost of borrowing, making monthly mortgage payments more expensive. Conversely, lower rates make homeownership more affordable.

- Current Homeowners: Mortgage rate trends this week 2025 can also impact current homeowners considering refinancing their existing mortgage. If rates are lower, refinancing can potentially save money on monthly payments. However, if rates are higher, refinancing may not be financially advantageous.

- Investors: Investors in the housing market, including real estate developers and landlords, need to consider the impact of mortgage rate trends this week 2025 on their investment strategies. Higher rates can impact the profitability of rental properties, while lower rates may make new construction projects more viable.

Related Searches: Exploring Further

To gain a more comprehensive understanding of the factors influencing mortgage rate trends this week 2025, it’s helpful to explore related searches that provide additional context and insights:

- Mortgage Rate Forecasts: Various financial institutions and analysts provide forecasts for mortgage rates. These forecasts, while not always accurate, can offer valuable insights into potential future trends.

- Current Mortgage Rates: Staying informed about current mortgage rates is essential for making informed decisions. Websites and financial institutions regularly update current rates, providing a snapshot of the market.

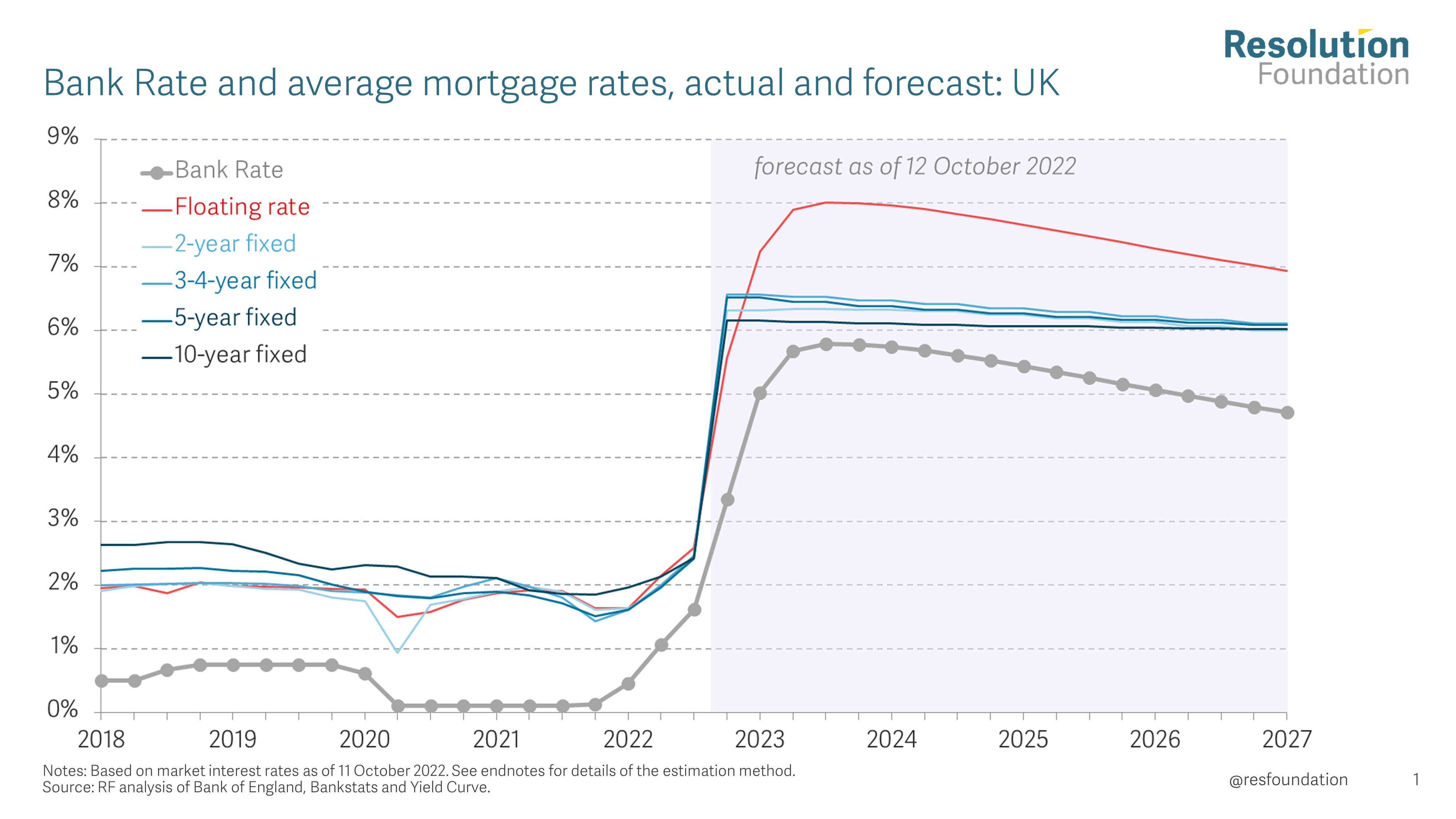

- Fixed vs. Adjustable-Rate Mortgages: Understanding the difference between fixed and adjustable-rate mortgages is crucial when making mortgage decisions. Fixed-rate mortgages provide stability with predictable payments, while adjustable-rate mortgages offer lower initial rates but carry the risk of higher rates in the future.

- Mortgage Loan Options: There are various mortgage loan options available, each with its own terms and conditions. Exploring these options, such as conventional loans, FHA loans, and VA loans, can help identify the best fit for individual circumstances.

- Mortgage Calculator: A mortgage calculator is a valuable tool for estimating monthly payments, total interest paid, and the overall cost of a mortgage based on different loan terms and rates.

- Refinancing Options: If you’re a current homeowner, exploring refinancing options can help you potentially lower your monthly payments or shorten your loan term.

- Home Equity Loans and Lines of Credit: Understanding home equity loans and lines of credit can provide alternative financing options for home improvements or other financial needs.

- Housing Market Trends: Staying abreast of broader housing market trends, including home prices, inventory levels, and sales activity, can provide valuable context for mortgage rate trends.

FAQs: Addressing Common Questions

1. What are the factors that influence mortgage rates?

- Mortgage rates are influenced by a complex interplay of factors, including the Federal Reserve’s monetary policy, inflation, global economic conditions, government policies, and housing market dynamics.

2. How are mortgage rates expected to change in 2025?

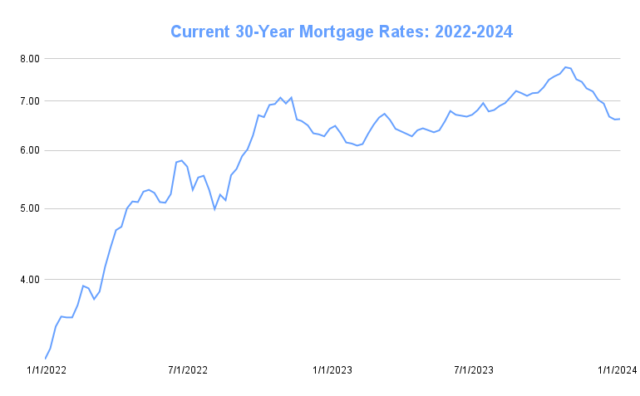

- Predicting future mortgage rates is challenging. However, analysts generally expect rates to remain volatile in 2025, potentially influenced by the Fed’s monetary policy response to inflation, global economic uncertainty, and the overall health of the housing market.

3. How can I find the best mortgage rates?

- To find the best mortgage rates, it’s recommended to shop around with multiple lenders. Online mortgage marketplaces and comparison websites can help you compare rates and find the best offers.

4. When is the best time to get a mortgage?

- There is no single best time to get a mortgage. However, generally, mortgage rates tend to be lower during periods of economic stability and low inflation.

5. What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

- A fixed-rate mortgage has a fixed interest rate for the entire loan term, providing predictable monthly payments. An adjustable-rate mortgage (ARM) has an initial fixed rate that adjusts periodically based on a benchmark interest rate, potentially leading to higher payments in the future.

6. What are the benefits of refinancing my mortgage?

- Refinancing your mortgage can potentially lower your monthly payments, shorten your loan term, or switch to a different loan type. However, refinancing costs and potential rate changes should be carefully considered.

Tips: Navigating the Mortgage Landscape

- Shop Around: Compare rates from multiple lenders to secure the best possible deal.

- Consider Your Financial Situation: Evaluate your debt-to-income ratio, credit score, and overall financial health to determine the best mortgage option.

- Understand the Loan Terms: Carefully review the loan terms, including interest rates, fees, and repayment schedule, before signing any documents.

- Stay Informed: Monitor mortgage rate trends and market conditions to make informed decisions.

- Seek Professional Advice: Consult with a mortgage broker or financial advisor for guidance and personalized recommendations.

Conclusion: Embracing the Dynamics of the Mortgage Market

Mortgage rate trends this week 2025 will continue to be shaped by a complex interplay of economic, political, and market forces. Understanding these trends is crucial for making informed decisions about homeownership, refinancing, or investment strategies. By staying informed, comparing options, and seeking professional advice, individuals and businesses can navigate the dynamic mortgage market effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Mortgage Rate Trends This Week 2025. We appreciate your attention to our article. See you in our next article!