Navigating the Uncharted Waters: Housing Market Trends in 2025

Navigating the Uncharted Waters: Housing Market Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Uncharted Waters: Housing Market Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Uncharted Waters: Housing Market Trends in 2025

- 2 Introduction

- 3 Navigating the Uncharted Waters: Housing Market Trends in 2025

- 3.1 Key Drivers Shaping the Housing Market Landscape

- 3.2 Exploring Related Searches:

- 3.3 Frequently Asked Questions (FAQs)

- 3.4 Tips for Navigating the Housing Market in 2025

- 3.5 Conclusion

- 4 Closure

Navigating the Uncharted Waters: Housing Market Trends in 2025

The housing market, a complex interplay of economic forces, demographic shifts, and societal preferences, is constantly evolving. As we stand at the precipice of 2025, understanding the trends shaping the landscape is crucial for individuals, investors, and policymakers alike. This comprehensive exploration delves into the key factors influencing the current housing market trends in 2025, providing insights into potential opportunities and challenges.

Key Drivers Shaping the Housing Market Landscape

1. Interest Rates and Mortgage Costs: The Federal Reserve’s monetary policy plays a pivotal role in shaping housing affordability. Rising interest rates, a tool used to combat inflation, directly impact mortgage rates, making homeownership more expensive. Conversely, lower interest rates can stimulate demand and drive up home prices. The trajectory of interest rates in the coming years will be a major determinant of housing market activity.

2. Inflation and Economic Growth: Inflationary pressures can erode purchasing power and increase the cost of building materials, ultimately impacting housing prices. Economic growth, on the other hand, can boost consumer confidence and increase demand for housing. The interplay of these factors will influence the affordability and accessibility of housing in 2025.

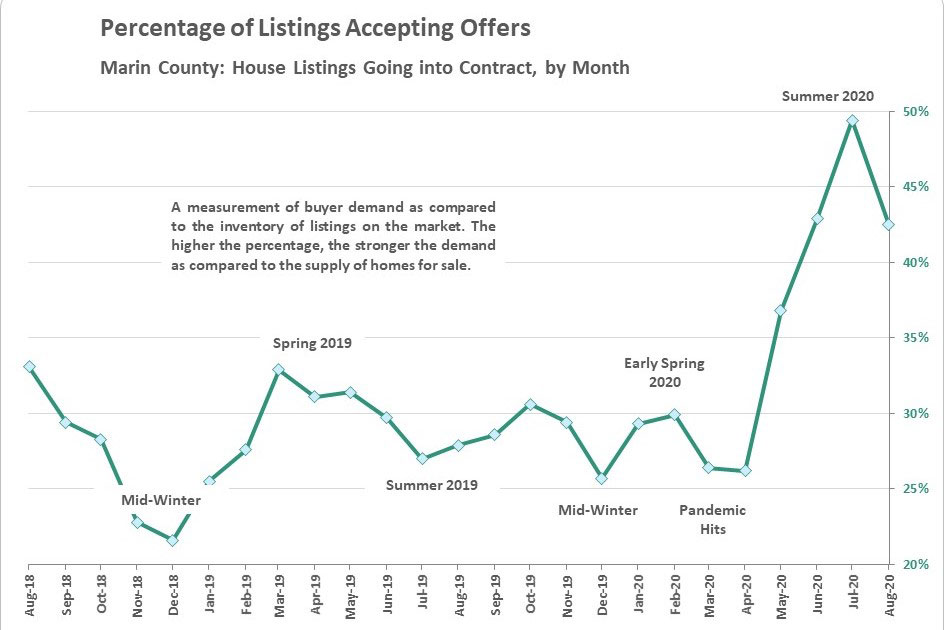

3. Supply and Demand Dynamics: The availability of housing units is a crucial factor influencing market trends. Limited housing supply in the face of growing demand can lead to price increases and reduced affordability. Conversely, an oversupply of housing can lead to price declines and market instability. Factors like zoning regulations, construction costs, and land availability influence the supply side of the equation.

4. Demographic Shifts and Housing Preferences: The changing demographics of the population, including aging baby boomers, millennial homebuyers, and growing urban populations, significantly influence housing preferences. This includes demand for different types of housing, such as single-family homes, multi-family units, and senior living facilities.

5. Technological Advancements and Innovation: Technological advancements are transforming the housing market. Smart home technologies, virtual reality tours, and online platforms for property transactions are enhancing the homebuying experience. Moreover, innovations in construction materials and techniques are leading to more sustainable and efficient homes.

6. Environmental Sustainability and Climate Change: Growing concerns about climate change and environmental sustainability are influencing housing choices. Consumers are increasingly seeking homes with energy-efficient features, renewable energy sources, and green building practices. This trend is likely to drive demand for sustainable housing options in 2025.

7. Government Policies and Regulations: Government policies, including tax incentives, zoning regulations, and housing subsidies, can significantly impact housing affordability and availability. Policy changes aimed at increasing housing supply, promoting affordability, and addressing climate change will shape the housing market in the coming years.

8. Global Economic Factors: The global economic landscape can influence domestic housing markets through factors such as trade, investment flows, and international interest rates. Economic instability or uncertainty in global markets can impact housing prices and investment decisions.

Exploring Related Searches:

1. Housing Market Predictions 2025: While predicting the future with certainty is impossible, analysts and economists offer forecasts based on current trends and economic indicators. These predictions can provide insights into potential price movements, supply and demand dynamics, and regional variations in the market.

2. Housing Bubble 2025: Concerns about a housing bubble resurfaced in recent years, driven by rapid price increases and low interest rates. Experts debate whether the current market conditions resemble a bubble and the potential risks associated with such a scenario.

3. Housing Affordability 2025: Housing affordability is a critical issue, particularly for first-time homebuyers and low-income households. Factors like rising home prices, stagnant wages, and limited housing supply contribute to affordability challenges. Understanding the factors driving affordability trends in 2025 is crucial for policymakers and individuals seeking to enter the housing market.

4. Housing Market Crash 2025: While a housing market crash is not inevitable, it is a possibility that investors and homeowners should consider. Factors like economic downturns, interest rate hikes, and overvaluation of assets can contribute to market instability. Understanding the potential risks and warning signs of a crash is essential for informed decision-making.

5. Housing Market Trends by Region: Housing market trends vary significantly across different regions due to factors such as local economic conditions, demographics, and housing supply. Analyzing regional trends can provide insights into specific opportunities and challenges in different markets.

6. Housing Market Trends by Property Type: The housing market is not monolithic. Trends in different property types, such as single-family homes, condominiums, and multi-family rentals, can diverge based on factors like demand, affordability, and investment preferences. Understanding these differences is crucial for investors and buyers seeking specific types of properties.

7. Housing Market Trends for Investors: Investors play a significant role in the housing market, both through buying and selling properties and through financing activities. Understanding the trends impacting investment opportunities, risk profiles, and potential returns is crucial for making informed decisions.

8. Housing Market Trends for First-Time Homebuyers: First-time homebuyers face unique challenges in the housing market, including affordability constraints, competition, and navigating the complex process of buying a home. Understanding the trends affecting first-time buyers can help them make informed decisions and navigate the market effectively.

Frequently Asked Questions (FAQs)

1. What are the most significant factors influencing the housing market in 2025?

The most significant factors influencing the housing market in 2025 include interest rates, inflation, supply and demand dynamics, demographic shifts, technological advancements, environmental concerns, government policies, and global economic factors.

2. How will rising interest rates impact the housing market?

Rising interest rates will likely lead to higher mortgage costs, making homeownership more expensive. This can decrease demand, slow down price growth, or even cause prices to decline.

3. What are the implications of limited housing supply?

Limited housing supply, especially in the face of growing demand, can drive up prices, making housing less affordable. It can also lead to increased competition among buyers and potentially create a seller’s market.

4. How will technological advancements influence the housing market?

Technological advancements are transforming the housing market by enhancing the homebuying experience, improving construction efficiency, and enabling the development of smart homes with innovative features.

5. What are the potential risks associated with a housing bubble?

A housing bubble can lead to rapid price increases followed by a sharp decline, resulting in financial losses for homeowners and investors. It can also destabilize the economy and contribute to broader financial crises.

6. What are some strategies for first-time homebuyers in a challenging market?

First-time homebuyers can consider strategies such as saving for a larger down payment, exploring government assistance programs, and seeking out affordable housing options in less competitive markets.

7. What are the implications of climate change for the housing market?

Climate change is increasing the risk of extreme weather events and rising sea levels, which can impact property values and insurance costs. This is driving demand for more resilient and sustainable housing options.

8. How can investors navigate the evolving housing market?

Investors can navigate the evolving housing market by diversifying their portfolios, focusing on long-term growth strategies, and staying informed about market trends and potential risks.

Tips for Navigating the Housing Market in 2025

1. Stay Informed: Regularly research and analyze market trends, economic indicators, and policy changes to make informed decisions.

2. Manage Your Finances: Maintain a healthy credit score, save for a down payment, and understand your affordability limits.

3. Consider Your Long-Term Goals: Define your housing needs and preferences, and align your investment decisions with your long-term goals.

4. Seek Professional Advice: Consult with a real estate agent, financial advisor, or mortgage lender to receive expert guidance and tailored advice.

5. Embrace Innovation: Explore technological advancements and innovations in the housing market to enhance your homebuying experience and discover new opportunities.

6. Prioritize Sustainability: Consider the environmental impact of your housing choices and seek out sustainable and energy-efficient homes.

7. Diversify Your Investments: If investing in real estate, diversify your portfolio across different property types, locations, and rental strategies.

8. Be Patient and Strategic: The housing market can be volatile. Remain patient, adopt a strategic approach, and avoid impulsive decisions.

Conclusion

The current housing market trends in 2025 are shaped by a complex interplay of economic, demographic, and technological forces. While navigating this dynamic landscape can be challenging, understanding the key drivers and trends can empower individuals, investors, and policymakers to make informed decisions. By staying informed, managing finances effectively, and seeking professional advice, individuals can navigate the housing market with confidence and achieve their housing goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: Housing Market Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!