Payment Trends 2025: A Look into the Future of Commerce

Payment Trends 2025: A Look into the Future of Commerce

Introduction

With great pleasure, we will explore the intriguing topic related to Payment Trends 2025: A Look into the Future of Commerce. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Payment Trends 2025: A Look into the Future of Commerce

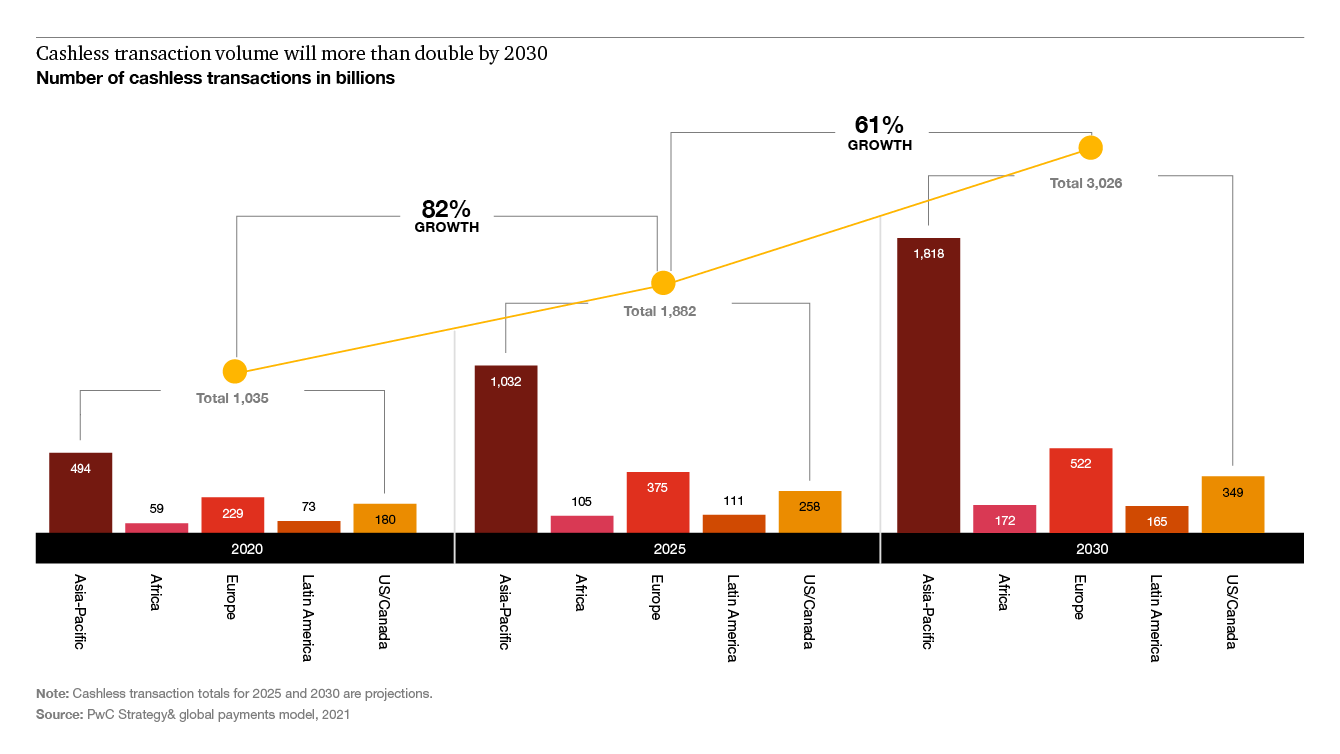

The landscape of commerce is constantly evolving, driven by technological advancements and changing consumer preferences. As we approach 2025, a new wave of payment trends is emerging, poised to redefine how individuals and businesses interact with money. Understanding these trends is crucial for businesses seeking to stay ahead of the curve and thrive in the digital economy.

The Rise of Digital Payments

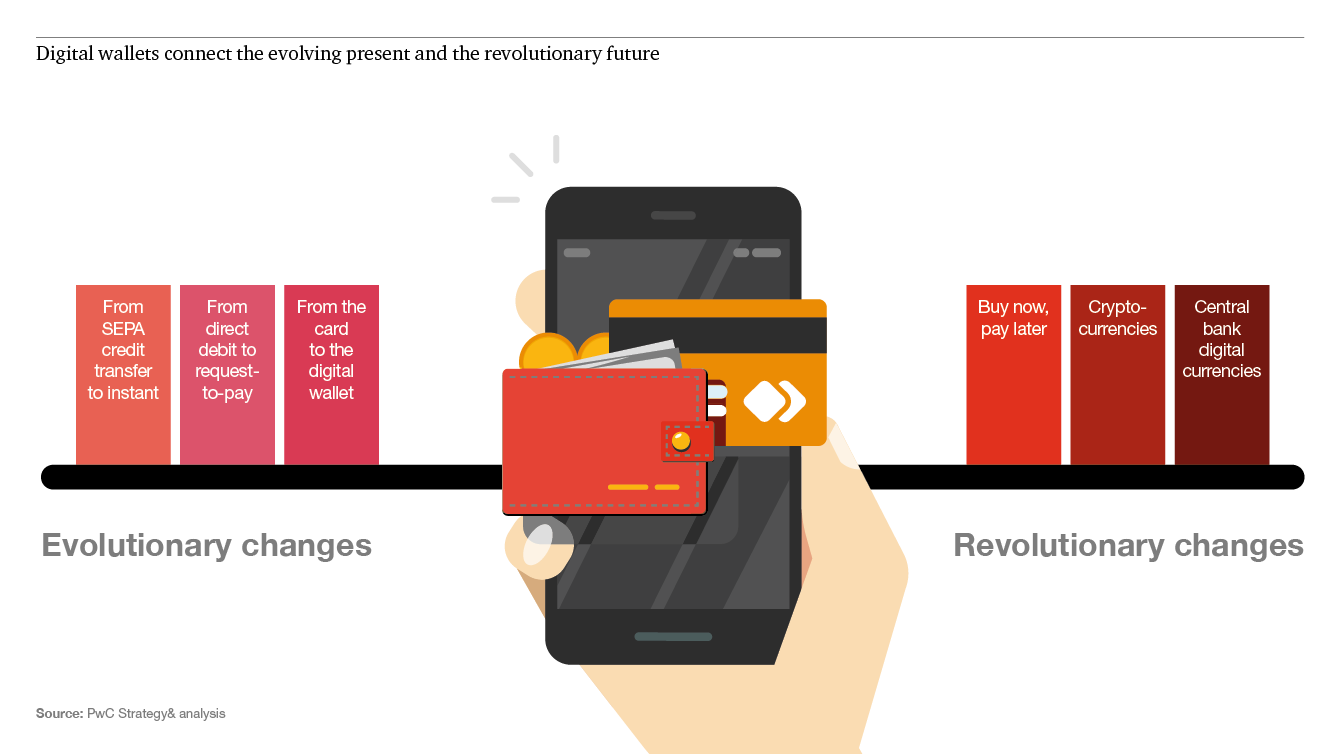

The shift towards digital payments has been accelerating for years, and this trend is only set to intensify in the coming years. Consumers are increasingly embracing the convenience, speed, and security offered by digital payment methods.

-

Mobile Wallets: These digital wallets, accessible through smartphones, offer a seamless and secure way to make payments. Popular options like Apple Pay, Google Pay, and Samsung Pay are expected to further penetrate the market, offering contactless payments and integration with various online and offline merchants.

-

Biometric Authentication: Security is paramount in the digital age. Biometric authentication, using fingerprint, facial, or iris recognition, is becoming increasingly prevalent, enhancing security and simplifying the payment process.

-

QR Code Payments: The widespread adoption of smartphones and QR code technology has propelled QR code payments into mainstream use. These payments offer a simple and convenient method for both online and offline transactions.

The Growing Influence of Fintech

Fintech companies are disrupting traditional financial institutions, introducing innovative payment solutions that cater to specific needs and preferences.

-

Buy Now, Pay Later (BNPL): This popular financing option allows consumers to make purchases and pay them off in installments, often with interest-free periods. BNPL providers like Klarna, Afterpay, and Affirm are gaining traction, particularly among younger demographics.

-

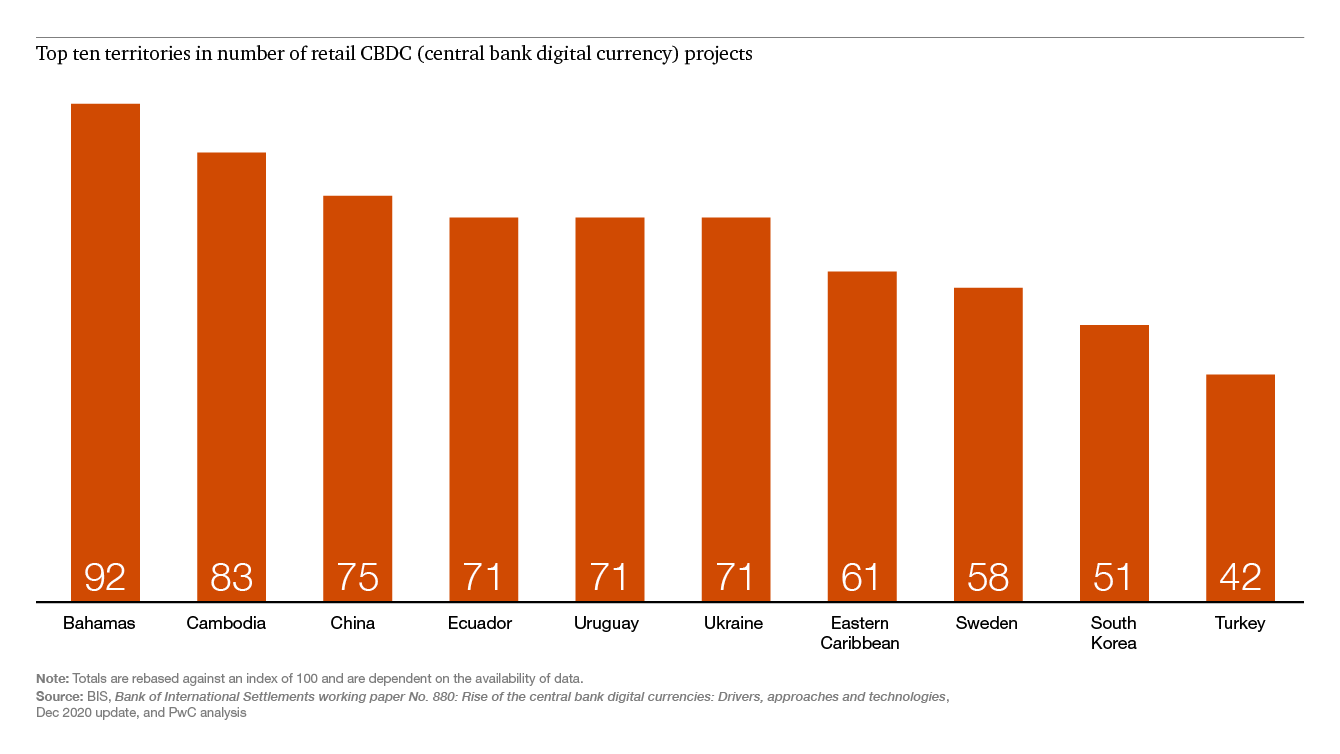

Cryptocurrency Payments: While still in its nascent stages, cryptocurrency adoption is gradually increasing. Businesses are exploring the use of cryptocurrencies like Bitcoin and Ethereum for payments, offering potential benefits like lower transaction fees and increased security.

-

Open Banking: This concept allows consumers to share their financial data with third-party applications, enabling personalized financial services and innovative payment solutions. Open banking fosters competition and innovation within the financial sector.

Embracing the Future of Payment

The future of payment is characterized by a convergence of technologies and evolving consumer expectations.

-

Artificial Intelligence (AI): AI is transforming the payment landscape by automating tasks, enhancing fraud detection, and personalizing payment experiences. AI-powered chatbots can assist with customer service, and AI algorithms can analyze spending patterns to provide personalized financial insights.

-

Internet of Things (IoT): As the number of connected devices grows, the potential for seamless and automated payments through IoT devices expands. Imagine paying for groceries through a smart refrigerator or ordering a coffee through a smart speaker.

-

Blockchain Technology: Beyond cryptocurrencies, blockchain technology offers a decentralized and secure platform for managing transactions. Its potential applications in payment systems extend beyond financial services, impacting supply chain management and identity verification.

Navigating the Payment Landscape

Understanding the evolving payment trends is crucial for businesses to adapt and thrive in the future.

-

Staying Updated: Businesses need to stay informed about emerging technologies and payment trends to ensure they can offer competitive solutions.

-

Flexibility and Adaptability: Businesses should be prepared to adapt their payment systems to meet the evolving needs of customers.

-

Security and Privacy: Protecting customer data and ensuring secure transactions are paramount. Businesses need to invest in robust security measures and adhere to data privacy regulations.

Related Searches

The dynamic nature of payment trends 2025 has generated a plethora of related searches, offering deeper insights into specific aspects of the evolving payment landscape.

1. Payment Trends in Retail

-

Contactless Payments: As concerns over hygiene and physical contact persist, contactless payments are becoming increasingly popular in retail settings. Businesses are embracing contactless payment options like NFC (Near Field Communication) technology and QR code payments to provide a safe and convenient shopping experience.

-

Mobile Point of Sale (mPOS): Mobile POS systems are empowering retailers to accept payments from anywhere, offering flexibility and convenience for both customers and businesses.

-

In-Store Digital Wallets: Retailers are integrating digital wallet solutions into their point-of-sale systems, allowing customers to make payments quickly and securely using their mobile devices.

2. Payment Trends in the Hospitality Industry

-

Mobile Ordering and Payment: Mobile ordering and payment apps are transforming the hospitality industry, allowing customers to place orders and pay for food and drinks directly from their smartphones. This streamlines the ordering process and enhances convenience for diners.

-

Digital Room Keys: Hotels are adopting digital room keys, enabling guests to access their rooms using their smartphones. This eliminates the need for physical keys, enhancing security and convenience.

-

Automated Check-in and Check-out: Technology is automating check-in and check-out processes, allowing guests to complete these formalities quickly and efficiently. This reduces wait times and enhances customer satisfaction.

3. Payment Trends in Healthcare

-

Telehealth Payments: The rise of telehealth services has created new payment challenges. Secure and convenient payment options are essential for facilitating virtual consultations and remote healthcare services.

-

Patient Portals: Patient portals are becoming increasingly prevalent, allowing patients to manage appointments, access medical records, and make payments online. This offers convenience and control over healthcare finances.

-

Health Savings Accounts (HSAs): HSAs are gaining popularity as a means to save for healthcare expenses. Businesses are integrating HSA payment options into their healthcare systems to provide patients with greater flexibility and control over their healthcare finances.

4. Payment Trends in Education

-

Online Tuition Payments: Educational institutions are embracing online payment options for tuition fees, making it easier for students to pay from anywhere. This eliminates the need for physical payments and streamlines the payment process.

-

Student Loan Repayments: Digital platforms are simplifying student loan repayment processes, allowing borrowers to manage their loans and make payments online. This offers convenience and transparency in loan management.

-

Campus-Based Payment Systems: Educational institutions are developing campus-based payment systems, allowing students to make purchases using their student IDs or mobile wallets. This eliminates the need for cash and provides a more convenient payment experience.

5. Payment Trends in the Travel Industry

-

Mobile Travel Booking: Travelers are increasingly booking flights, hotels, and other travel arrangements through mobile apps. This trend is driving the need for seamless and secure payment options within these apps.

-

Travel Insurance Payments: Travel insurance providers are offering online payment options, making it easier for travelers to purchase insurance policies.

-

Travel Rewards Programs: Loyalty programs are becoming increasingly sophisticated, offering customers rewards and incentives for using specific payment methods.

6. Payment Trends in the Gaming Industry

-

In-Game Purchases: The gaming industry is heavily reliant on in-game purchases. Digital payment methods, including mobile wallets and cryptocurrency, are becoming increasingly popular for these transactions.

-

Esports Betting: The growth of esports has led to an increase in esports betting. Secure and reliable payment methods are essential for facilitating these transactions.

-

Game Subscription Services: Game subscription services like Xbox Game Pass and PlayStation Plus are gaining traction, requiring secure and convenient payment options for subscription management.

7. Payment Trends in the Gig Economy

-

Digital Payment Platforms: Platforms like Uber, Lyft, and DoorDash are heavily reliant on digital payment systems for facilitating transactions between gig workers and customers.

-

Instant Payment Options: Gig workers need access to fast and reliable payment options to receive their earnings promptly. Instant payment services are becoming increasingly popular in the gig economy.

-

Financial Inclusion: Digital payment platforms are providing financial inclusion for gig workers, offering access to banking and financial services.

8. Payment Trends in the Metaverse

-

Virtual Currency and NFTs: The metaverse is creating a new ecosystem for virtual currency and non-fungible tokens (NFTs). These digital assets are used for payments and transactions within virtual worlds.

-

Decentralized Finance (DeFi): DeFi platforms are emerging in the metaverse, offering decentralized financial services and payment options.

-

Immersive Payment Experiences: The metaverse is blurring the lines between the physical and digital worlds, creating new opportunities for immersive payment experiences.

FAQs by Payment Trends 2025

1. What are the key drivers of payment trends 2025?

The key drivers of payment trends 2025 include:

- Technological advancements: Advancements in mobile technology, artificial intelligence, and blockchain are driving innovation in payment systems.

- Changing consumer preferences: Consumers are increasingly demanding convenience, speed, and security in their payment experiences.

- Globalization and cross-border commerce: The rise of cross-border commerce is driving the need for global payment solutions.

- Regulatory changes: New regulations and data privacy laws are shaping the payment landscape.

2. How will payment trends 2025 impact businesses?

Payment trends 2025 will have a significant impact on businesses, requiring them to:

- Adapt to new payment methods: Businesses need to offer a range of payment options to meet the diverse needs of their customers.

- Invest in technology: Businesses need to invest in technology to streamline payment processes and enhance security.

- Focus on customer experience: Businesses need to prioritize customer experience by providing convenient and secure payment options.

- Stay informed about regulatory changes: Businesses need to stay abreast of evolving regulations to ensure compliance.

3. What are the benefits of payment trends 2025?

Payment trends 2025 offer several benefits for both consumers and businesses:

- Increased convenience: Digital payment methods provide a more convenient and efficient way to make payments.

- Enhanced security: Biometric authentication and advanced fraud detection technologies enhance the security of payment transactions.

- Greater financial inclusion: Digital payment systems provide access to financial services for underserved populations.

- Improved efficiency: Automated payment processes and AI-powered solutions streamline transactions and reduce costs.

4. What are the challenges of payment trends 2025?

Payment trends 2025 also present some challenges:

- Security risks: The rise of digital payments increases the risk of cybercrime and data breaches.

- Data privacy concerns: The collection and use of customer data raise privacy concerns.

- Integration complexity: Integrating new payment systems can be complex and time-consuming.

- Lack of awareness: Consumers may not be fully aware of the benefits and security of new payment methods.

Tips by Payment Trends 2025

- Embrace a Multi-Channel Strategy: Offer a diverse range of payment options to cater to different customer preferences.

- Prioritize Security: Invest in robust security measures to protect customer data and prevent fraud.

- Foster Customer Education: Educate customers about the benefits and security of new payment methods.

- Stay Agile and Adaptable: Be prepared to adapt to changing trends and technological advancements.

- Partner with Fintech Companies: Explore partnerships with fintech companies to leverage innovative payment solutions.

Conclusion by Payment Trends 2025

Payment trends 2025 are shaping the future of commerce, driving innovation and transforming how individuals and businesses interact with money. By embracing these trends, businesses can enhance customer experiences, streamline operations, and gain a competitive edge in the digital economy. As technology continues to evolve, the payment landscape will undoubtedly continue to shift, offering new opportunities and challenges for businesses to navigate. Adaptability, innovation, and a focus on customer needs will be key to success in the future of payments.

Closure

Thus, we hope this article has provided valuable insights into Payment Trends 2025: A Look into the Future of Commerce. We hope you find this article informative and beneficial. See you in our next article!