The Evolving Landscape of Payments: A Look at Key Trends for 2025

The Evolving Landscape of Payments: A Look at Key Trends for 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Evolving Landscape of Payments: A Look at Key Trends for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Payments: A Look at Key Trends for 2025

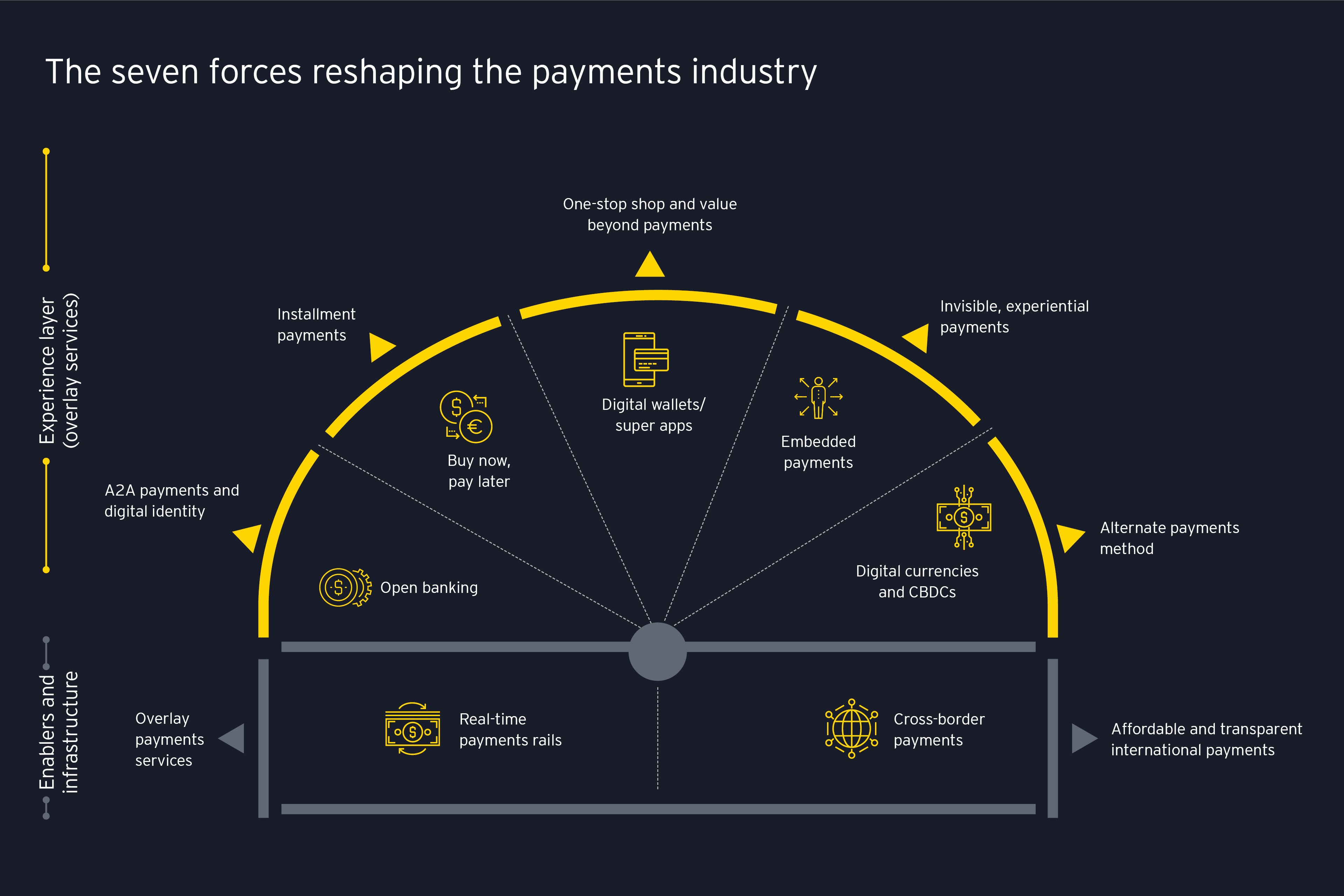

The payments landscape is in a constant state of flux, driven by technological advancements, changing consumer preferences, and the rise of new business models. As we move towards 2025, several key trends are poised to reshape how individuals and businesses transact. Understanding these trends is crucial for businesses to adapt, innovate, and stay ahead of the curve.

The Future of Payments: A Look at Key Trends for 2025

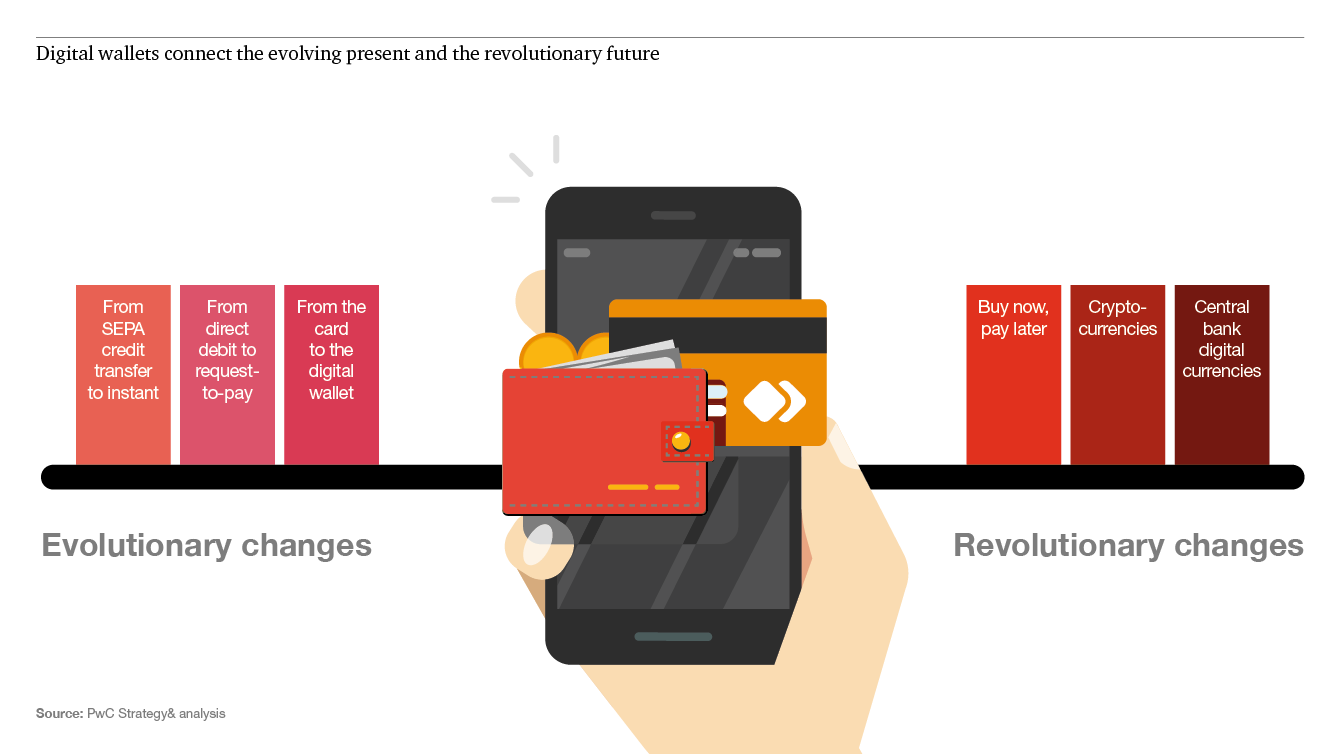

1. The Rise of Digital Payments

The shift towards digital payments has been accelerating for years, and this trend is only expected to intensify in the coming years. Consumers are increasingly comfortable with digital wallets, mobile payment apps, and online banking platforms. This shift is fueled by several factors, including:

- Convenience: Digital payments are faster and more convenient than traditional methods like cash or checks.

- Security: Digital payment systems often offer enhanced security features, reducing the risk of fraud and theft.

- Accessibility: Digital payments can be made from anywhere with an internet connection, expanding access to financial services for individuals and businesses.

2. The Growth of Buy Now, Pay Later (BNPL) Solutions

BNPL services have gained significant traction in recent years, offering consumers a flexible and accessible way to pay for purchases. These services allow customers to spread payments over time, often with interest-free installments, making larger purchases more manageable. This trend is likely to continue, with BNPL solutions expanding into new markets and offering more integrated services.

- Increased Affordability: BNPL solutions make expensive purchases more accessible by breaking them down into smaller, manageable installments.

- Enhanced Shopping Experience: BNPL services often integrate seamlessly with online shopping platforms, providing a convenient and streamlined checkout experience.

- Data-Driven Insights: BNPL providers collect valuable data on consumer spending habits, allowing them to offer personalized offers and tailor their services to individual needs.

3. The Integration of Artificial Intelligence (AI)

AI is revolutionizing the payments industry by automating processes, enhancing security, and personalizing customer experiences. AI-powered solutions are being used for:

- Fraud Detection: AI algorithms can analyze transaction data in real time to identify suspicious activity and prevent fraudulent transactions.

- Personalized Recommendations: AI can analyze customer spending patterns and preferences to recommend relevant products and services.

- Automated Customer Service: AI-powered chatbots can provide 24/7 support and answer customer queries, freeing up human agents for more complex tasks.

4. The Expansion of Open Banking

Open banking allows third-party applications to access and utilize consumer financial data with their consent. This trend is creating new opportunities for innovative financial services, including:

- Personalized Financial Management: Open banking enables the development of financial management apps that provide a comprehensive view of a customer’s financial situation.

- Enhanced Payment Experiences: Open banking allows for smoother and more secure payments by streamlining the authentication process and providing real-time account information.

- New Financial Products and Services: Open banking enables the development of new financial products and services tailored to specific customer needs, such as personalized loans and insurance policies.

5. The Rise of Cryptocurrencies and Blockchain Technology

Cryptocurrencies and blockchain technology are gaining momentum in the payments industry, offering potential benefits like:

- Decentralization: Blockchain technology allows for peer-to-peer transactions without the need for intermediaries, reducing costs and increasing transparency.

- Security: Cryptocurrencies are secured by cryptography, making them less susceptible to fraud and theft.

- Faster Transactions: Blockchain technology can process transactions faster than traditional systems, reducing wait times and improving efficiency.

6. The Importance of Security and Privacy

As the payments landscape becomes increasingly digital, security and privacy are paramount. Businesses must prioritize robust security measures to protect sensitive customer data and prevent fraud. This includes:

- Multi-Factor Authentication: Implementing multi-factor authentication adds an extra layer of security to online accounts.

- Data Encryption: Encrypting sensitive data during transmission and storage protects it from unauthorized access.

- Regular Security Audits: Conducting regular security audits helps identify vulnerabilities and ensure compliance with industry standards.

7. The Growing Demand for Personalized Experiences

Consumers are increasingly demanding personalized experiences, and the payments industry is responding. This trend is driven by:

- Data Analytics: Businesses are leveraging data analytics to understand customer preferences and tailor their offerings accordingly.

- AI-Powered Recommendations: AI algorithms can analyze customer spending patterns and recommend relevant products and services.

- Personalized Payment Options: Businesses are offering customized payment options, such as flexible payment plans and loyalty programs, to enhance customer satisfaction.

8. The Importance of Seamless Integration

As the payments ecosystem becomes more complex, seamless integration is crucial. Businesses need to ensure their payment systems integrate seamlessly with other platforms and services to provide a frictionless customer experience. This includes:

- API Integration: Utilizing application programming interfaces (APIs) allows for easy integration with other systems and services.

- Unified Payment Platforms: Businesses are adopting unified payment platforms that streamline the payment process and offer a range of payment options.

- Omni-Channel Payments: Offering a consistent payment experience across all channels, including online, mobile, and in-store, is essential for customer satisfaction.

Related Searches

1. Payment Trends 2025: The Future of Mobile Payments

Mobile payments are already a significant part of the payments landscape, and this trend is expected to continue. As smartphones become increasingly ubiquitous, mobile payment apps are becoming the preferred method for many consumers. This trend is driven by factors like:

- Convenience: Mobile payments are incredibly convenient, allowing users to make payments with a few taps on their smartphones.

- Security: Mobile payment apps often incorporate advanced security features, such as fingerprint authentication and facial recognition.

- Integration with Other Services: Mobile payment apps are increasingly integrating with other services, such as ride-sharing platforms and online shopping platforms.

2. Payment Trends 2025: The Role of Biometrics

Biometric authentication is becoming increasingly popular in the payments industry, offering a secure and convenient way to verify identity. Biometric authentication methods include:

- Fingerprint Scanning: Fingerprint scanning is a widely used biometric authentication method that is both secure and convenient.

- Facial Recognition: Facial recognition technology is becoming increasingly sophisticated, offering a contactless and secure way to authenticate payments.

- Iris Scanning: Iris scanning is a highly secure biometric authentication method that is becoming increasingly popular in high-security applications.

3. Payment Trends 2025: The Impact of the Internet of Things (IoT)

The Internet of Things (IoT) is transforming the payments industry by enabling new payment methods and creating new opportunities for businesses. IoT devices can be used for:

- Micro-Payments: IoT devices can be used to make small, recurring payments, such as for subscriptions or utilities.

- Automated Payments: IoT devices can be programmed to make payments automatically, such as for parking fees or toll charges.

- Personalized Payment Experiences: IoT devices can collect data on user preferences and spending habits, enabling businesses to offer personalized payment experiences.

4. Payment Trends 2025: The Rise of Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms and applications. This trend is creating new opportunities for businesses to offer financial services to their customers. Examples include:

- Retailers Offering Loans: Retailers can offer financing options to their customers at the point of sale.

- Ride-Sharing Apps Offering Insurance: Ride-sharing apps can offer insurance policies to their drivers and passengers.

- E-commerce Platforms Offering Payment Solutions: E-commerce platforms can offer payment processing services to their merchants.

5. Payment Trends 2025: The Importance of Regulatory Compliance

The payments industry is subject to a complex web of regulations, and compliance is essential for businesses to operate legally and ethically. Key regulatory considerations include:

- Data Privacy Regulations: Businesses must comply with data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

- Anti-Money Laundering (AML) Regulations: Businesses must comply with anti-money laundering regulations to prevent financial crime.

- Know Your Customer (KYC) Regulations: Businesses must comply with know your customer regulations to verify the identity of their customers and prevent fraud.

6. Payment Trends 2025: The Future of Cross-Border Payments

Cross-border payments are becoming increasingly important as businesses expand their operations globally. However, cross-border payments can be complex and expensive. New technologies and solutions are emerging to address these challenges, including:

- Blockchain Technology: Blockchain technology can facilitate faster and more efficient cross-border payments by eliminating intermediaries and reducing costs.

- Global Payment Networks: Global payment networks are expanding their reach, offering businesses a wider range of payment options and lower transaction fees.

- Real-Time Currency Conversion: Real-time currency conversion technologies are making it easier for businesses to process cross-border payments without incurring exchange rate fluctuations.

7. Payment Trends 2025: The Impact of Emerging Markets

Emerging markets are experiencing rapid growth in digital payments, driven by factors like increased smartphone penetration and a growing middle class. This trend is creating new opportunities for businesses to expand their reach and tap into new markets.

8. Payment Trends 2025: The Importance of Customer Experience

Customer experience is becoming increasingly important in the payments industry. Businesses need to offer a seamless, secure, and convenient payment experience to retain customers and drive loyalty. This includes:

- User-Friendly Interfaces: Payment platforms should be easy to use and navigate.

- Multiple Payment Options: Businesses should offer a variety of payment options to cater to different customer preferences.

- 24/7 Customer Support: Businesses should provide readily available customer support to address customer queries and resolve issues.

FAQs

1. What are the biggest challenges facing the payments industry in 2025?

The payments industry faces several challenges in 2025, including:

- Maintaining Security and Privacy: As the payments landscape becomes increasingly digital, protecting sensitive customer data and preventing fraud is paramount.

- Keeping Up with Technological Advancements: The rapid pace of technological advancements requires businesses to constantly adapt and innovate to stay ahead of the curve.

- Meeting Regulatory Requirements: The payments industry is subject to a complex web of regulations, and compliance is essential for businesses to operate legally and ethically.

- Adapting to Changing Consumer Preferences: Consumer preferences are constantly evolving, and businesses must adapt their offerings to meet these changing demands.

2. How can businesses prepare for the payments trends of 2025?

Businesses can prepare for the payments trends of 2025 by:

- Investing in Digital Payments Infrastructure: Businesses should invest in robust digital payment platforms and integrate them with their existing systems.

- Exploring New Payment Technologies: Businesses should stay informed about emerging payment technologies, such as BNPL, AI, and blockchain, and consider how they can be incorporated into their operations.

- Prioritizing Customer Experience: Businesses should focus on providing a seamless, secure, and convenient payment experience to retain customers and drive loyalty.

- Building Strong Partnerships: Businesses should form partnerships with technology providers, payment processors, and other stakeholders to leverage their expertise and accelerate innovation.

3. What are the potential benefits of these payment trends for consumers?

These payment trends offer several potential benefits for consumers, including:

- Increased Convenience: Digital payments, mobile wallets, and BNPL solutions offer greater convenience and flexibility.

- Enhanced Security: Digital payment systems often offer enhanced security features, reducing the risk of fraud and theft.

- Greater Access to Financial Services: Digital payments and open banking expand access to financial services for individuals and businesses.

- Personalized Experiences: Data analytics and AI-powered recommendations can create more personalized and relevant payment experiences.

4. What are the potential risks of these payment trends?

These payment trends also present potential risks, including:

- Security Breaches: Digital payments are vulnerable to security breaches, and businesses must take steps to protect sensitive customer data.

- Data Privacy Concerns: The collection and use of customer data raise privacy concerns, and businesses must comply with regulations and ensure responsible data handling.

- Financial Exclusion: The shift towards digital payments could potentially exclude individuals without access to technology or financial services.

- Over-Indebtedness: BNPL solutions can lead to over-indebtedness if consumers are not careful about managing their finances.

Tips

- Embrace Digital Payments: Businesses should prioritize digital payment options, offering a variety of methods, including mobile wallets, online payment gateways, and card payments.

- Invest in Security: Businesses must prioritize robust security measures to protect sensitive customer data and prevent fraud.

- Stay Informed About Emerging Technologies: Businesses should stay informed about emerging payment technologies and explore how they can be incorporated into their operations.

- Prioritize Customer Experience: Businesses should focus on providing a seamless, secure, and convenient payment experience to retain customers and drive loyalty.

- Build Strong Partnerships: Businesses should form partnerships with technology providers, payment processors, and other stakeholders to leverage their expertise and accelerate innovation.

Conclusion

The payments landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and the rise of new business models. As we move towards 2025, several key trends are poised to reshape how individuals and businesses transact. Businesses that understand and adapt to these trends will be well-positioned to succeed in the evolving payments ecosystem.

By embracing digital payments, investing in security, staying informed about emerging technologies, prioritizing customer experience, and building strong partnerships, businesses can navigate the complex and dynamic payments landscape and achieve sustainable growth.

The future of payments is promising, offering greater convenience, security, and accessibility for both consumers and businesses. By embracing these trends, we can create a more efficient, innovative, and inclusive payments ecosystem that benefits everyone.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Payments: A Look at Key Trends for 2025. We hope you find this article informative and beneficial. See you in our next article!